In a competitive landscape featuring global giants with vast resources, it may seem like an uphill battle for local aggregate producers to carve out a market share. However, states like Alaska show a unique market dynamic, where a diverse range of producers competes effectively. How do local companies stand their ground against these Goliaths? This article aims to uncover the secret sauce that allows smaller local firms to be a David in a world full of Goliaths.

The Case of Alaska: Diversity Defies Monopoly in Aggregate Producers

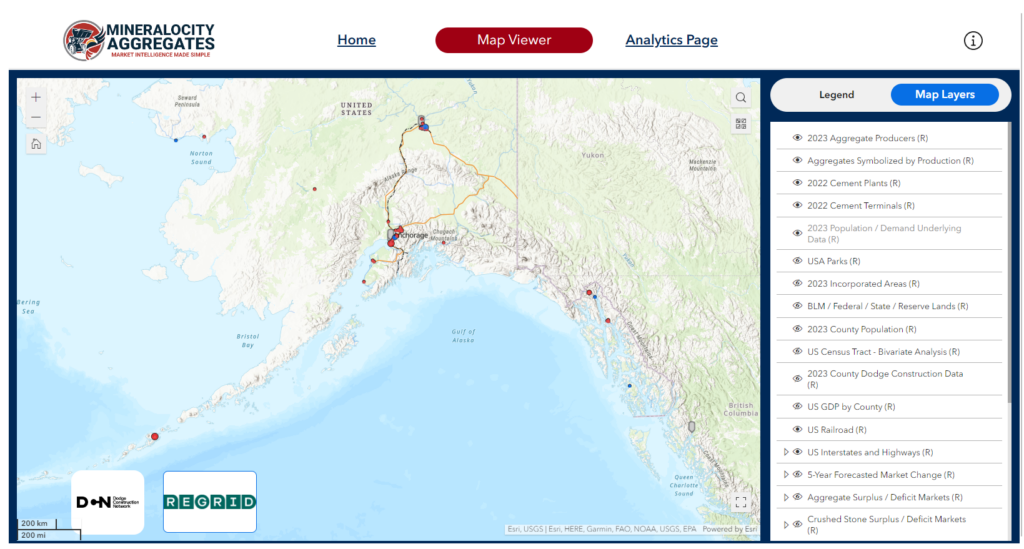

While aggregate markets in many regions tend to be dominated by a few large players, Alaska presents a unique case where no single company holds a monopoly. The competitive landscape is diversified, which is indicative of the region’s unique challenges and opportunities. Let’s look at the top three aggregate producers in Alaska:

Colas SA: 7% Market Share

Colas SA is a global powerhouse hailing from France, with diversified interests ranging from civil engineering to road building, railroads, and, of course, construction aggregates. The company’s broad expertise and international reach allow it to bring cutting-edge technologies and practices to Alaska’s aggregate market. Operating in a locale that has its own unique set of challenges—ranging from extreme weather conditions to logistics—Colas SA has proven its capability to adapt and innovate.

Anchorage Sand & Gravel Company Inc: 6% Market Share

With over 85 years of operational history, Anchorage Sand & Gravel Company Inc is deeply rooted in Alaska’s construction landscape. Based in Anchorage, most of their aggregate supplies come from the Palmer region and are transported via rail to their base. The company’s long history and local expertise make it a go-to choice for many Alaskan construction projects, both big and small. The company is likely to be one of the oldest aggregate producers in the state. Their local sourcing strategy also helps in reducing the carbon footprint and supports regional economic development.

Brice Incorporated: 6% Market Share

Brice Incorporated is another key player that adds to Alaska’s diverse aggregate market. Unlike Colas SA, Brice is a home-grown Alaskan business. Operating under the umbrella of Brice Companies, they offer a wide range of services from civil construction to marine services, equipment rentals, and quarry materials. Brice Incorporated stands out for its capability to complete projects in Alaska’s most remote locations, often under challenging conditions. The company’s reputation for delivering quality work on time and within budget has made it a preferred choice for many in the state.

Local producers can compete heavily with major national producers in Alaska, let’s explore why:

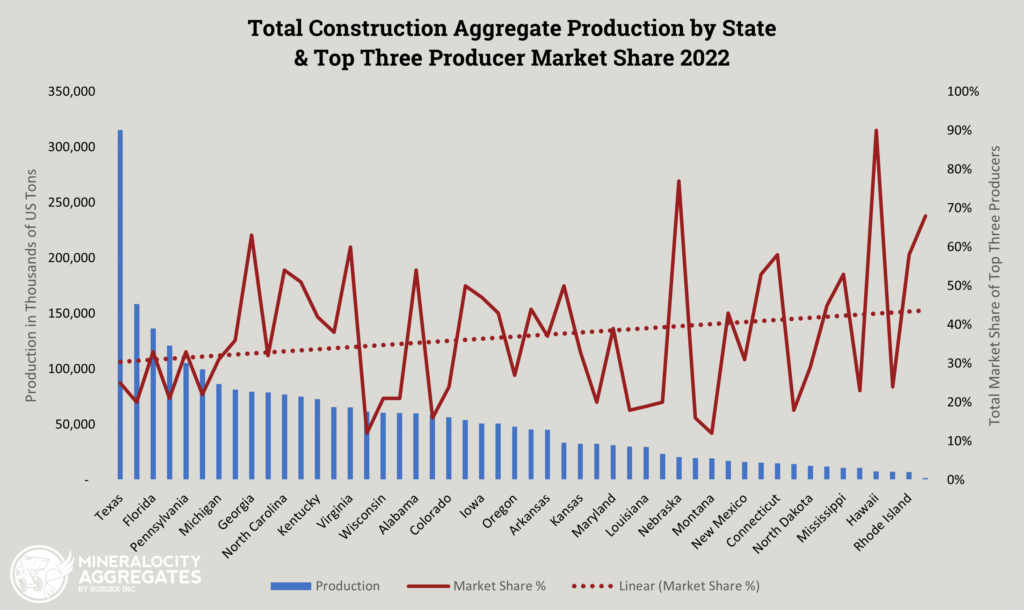

Geographic Challenges as an Equalizer of Aggregate Producers

In Alaska, the dispersion of population centers is not just a logistical hurdle; it’s a defining aspect of the local aggregate industry. The state’s sprawling landmass, punctuated by mountain ranges, rivers, and large swathes of unoccupied territories, makes it exceedingly challenging for any single entity to monopolize distribution. Unlike in the contiguous states, where major highways and extensive rail networks facilitate the rapid movement of materials, Alaska’s infrastructure is limited, often requiring a combination of road, rail, and even sea or air transport to reach remote areas.

Many of Alaska’s population centers are not only widely spaced but also highly isolated, sometimes accessible only by boat or plane. Such locations include small coastal communities, indigenous villages, and work camps for oil, gas, and mining operations. This isolation transforms logistics from a routine business consideration into a critical factor for the aggregate market. It’s not merely about getting the aggregate materials from Point A to Point B; it’s about overcoming a gauntlet of geographic, climatic, and infrastructural challenges that can fluctuate seasonally, or even daily.

As a result, the ability of local aggregate producers to adapt quickly and offer more tailored services becomes a significant competitive advantage. They can often provide materials with shorter lead times and more customized delivery plans than larger corporations, which may not be as attuned to Alaska’s unique challenges. In essence, the state’s geography serves as an equalizer, fostering a more diverse landscape of aggregate producers and offering opportunities for local businesses to carve out their own specialized niches.

Low Overhead: The David's Sling

Another advantage local companies have is lower overhead costs. These companies can be nimble, allowing them to pop up where smaller-scale production meets market demands, which can be cost-prohibitive for major players.

Strategies for Local Aggregate Producers

Focus on Niche Markets

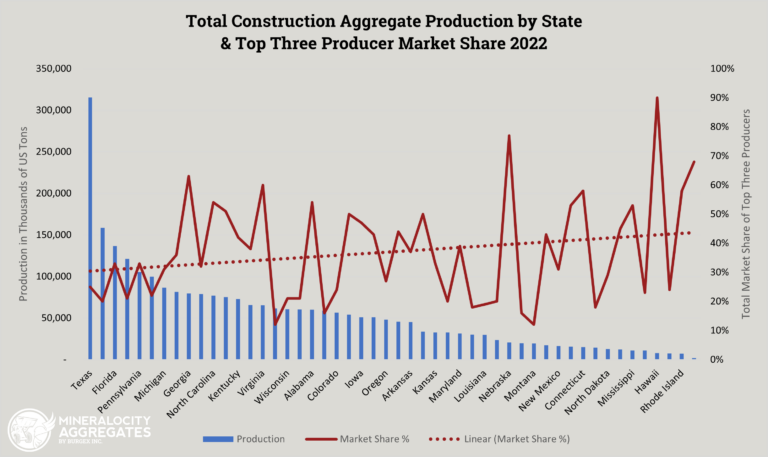

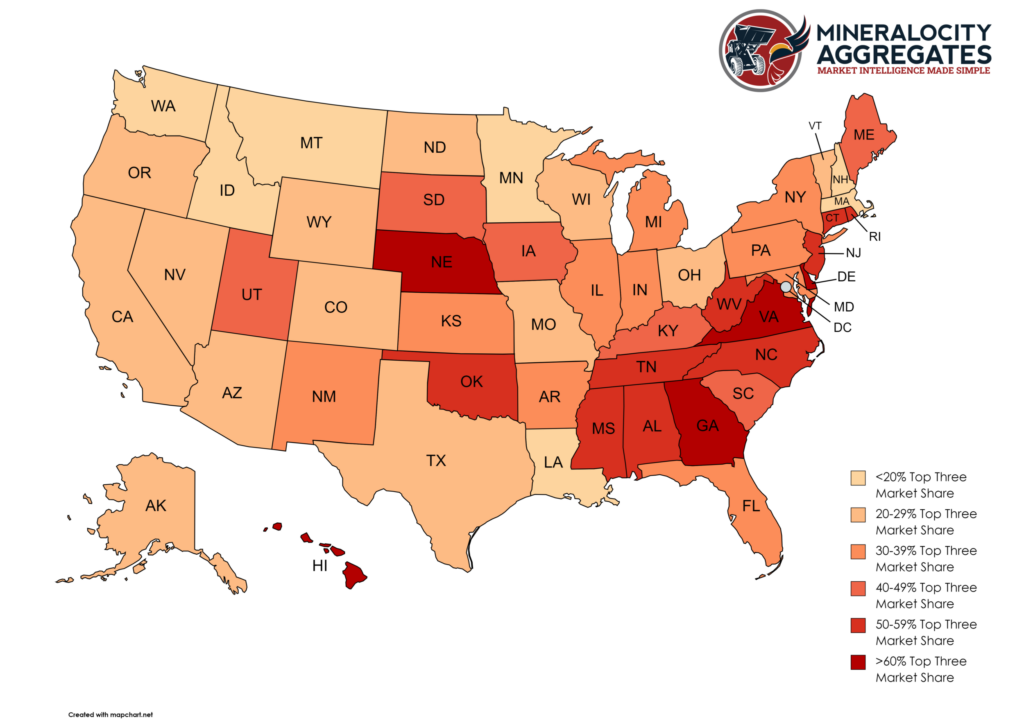

As seen in states like Idaho and Nevada where the top producers only have a market share of around 9%, local companies can compete by specializing in niche markets or products that bigger companies might overlook. Many small, yet growing markets may have not yet reached a level where the major players consider it worth investment.

Leverage Local Relationships

Companies like Anchorage Sand & Gravel and Brice Incorporated in Alaska use their local relationships to secure long-term contracts that may not be as accessible to global firms who aren’t as familiar with local community needs and business culture.

Agility and Quick Decision-making

Local producers can often make quicker decisions without going through layers of corporate bureaucracy. This agility allows them to adapt rapidly to market changes, be it fluctuating demand or disruptions in supply chains.

Case Studies from Other States

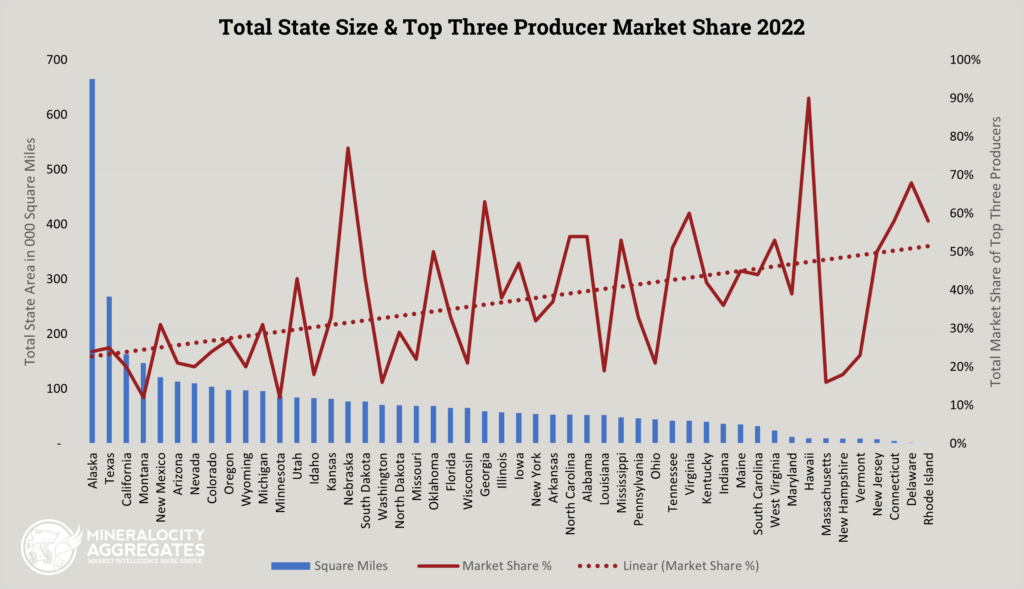

While Alaska offers a compelling example of a market where no single aggregate producer holds a monopoly, it is far from being an outlier. Several other states, including Arizona and Colorado, similarly demonstrate diverse market shares among top producers. This diversity provides a conducive environment for both local and national businesses to operate and grow. Below, we delve into the unique market landscapes in Arizona and Colorado.

Arizona: A Blend of National and Local Powerhouses

In Arizona, the aggregate market is characterized by a blend of both national and local producers. Companies like Vulcan Materials and Cemex share the space with Arizona-based businesses such as Superstition Crushing. The state’s growing urban centers, like Phoenix and Tucson, provide a robust demand for aggregates, making it a lucrative market for various players. Additionally, the state’s focus on sustainable sourcing practices offers opportunities for businesses to incorporate eco-friendly operations.

Colorado: Geographical Diversity Spurs Market Fragmentation

Colorado’s aggregate market is fragmented, much like its varied geography. With regions ranging from the Rocky Mountains to the Eastern Plains, the state has a diversified set of aggregate needs. This diversity allows companies specializing in different types of aggregates to co-exist and thrive. Companies like Martin Marietta and LafargeHolcim find themselves competing with local producers like Whitewater Building Materials Corp. Moreover, the state’s investment in infrastructure projects provides a constant demand, creating room for new entrants.

Opportunities for Local Businesses

The case studies of Arizona and Colorado underscore that opportunities abound for local businesses to gain a foothold in the market. These states, much like Alaska, demonstrate that market diversity and competitiveness can be the norm rather than the exception. Entrepreneurs and small to mid-size businesses can take inspiration from these markets to develop strategies tailored to local conditions, whether it be through specializing in a specific type of aggregate or through adopting sustainable practices that resonate with local demand.

Conclusion

While the competition is fierce, and the opponents are massive, the story of David vs Goliath is alive and well in the aggregate industry across the United States. From Alaska to Arizona, local firms can employ a range of strategies to compete effectively against global heavyweights. In an industry that often seems dominated by giants, there’s still room for the smaller players to not only survive but thrive.

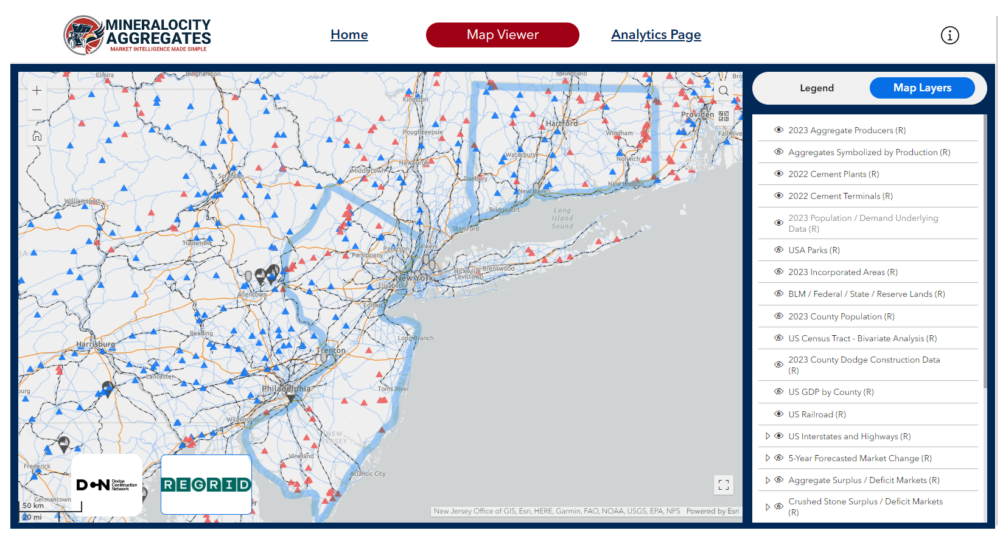

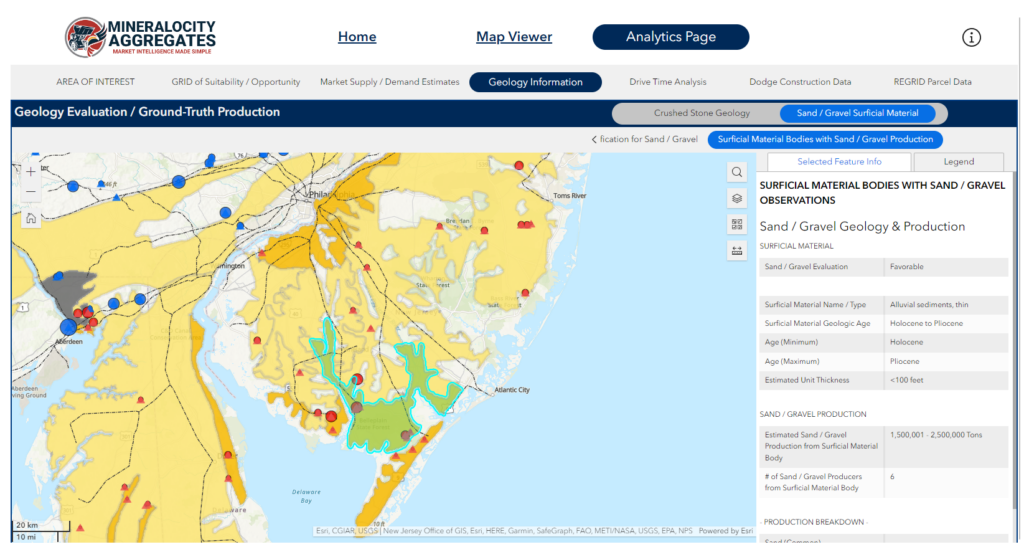

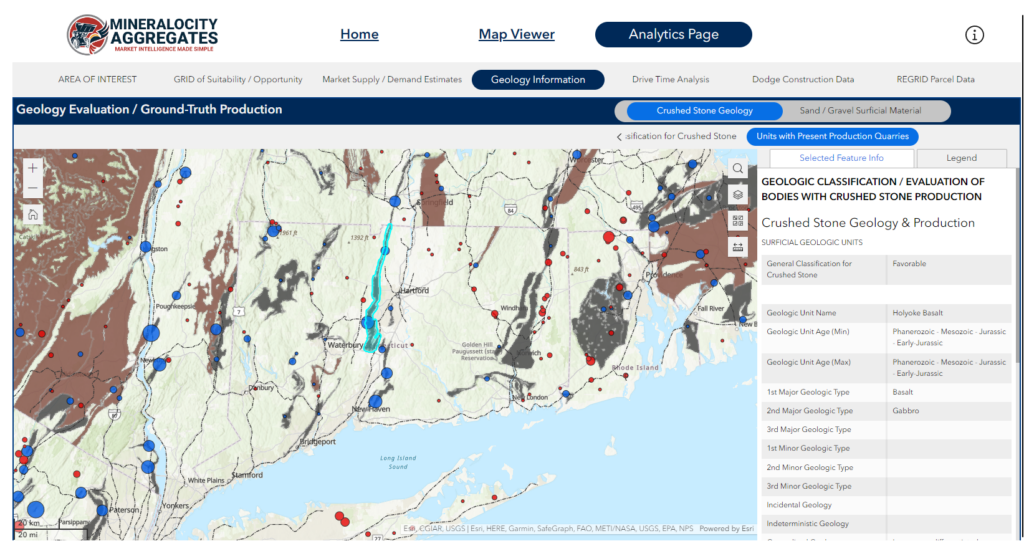

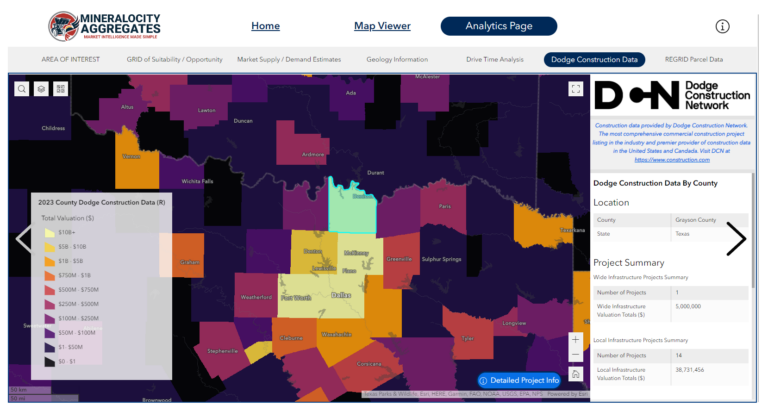

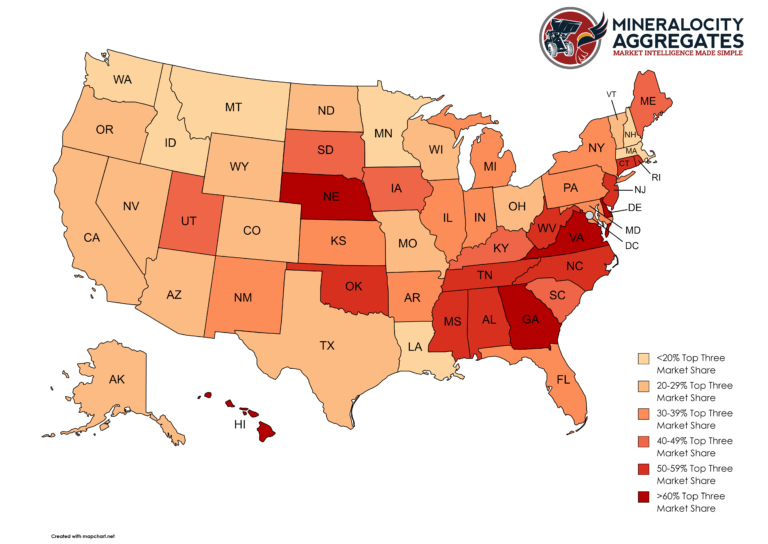

Interested in diving deeper into this topic? Check out Mineralocity Aggregates, a cutting-edge platform offering comprehensive market intelligence, including insightful data on how local and global companies are competing in every state. Check out our Top Aggregate Producers Report to learn more about the top producers in each US state.

Unlock exclusive, groundbreaking market data with the 2022 Top Aggregate Producers Report. Don't miss out!

Gain a competitive edge with our 2022 Top Aggregate Producers Report! Get exclusive market share data on top producers in each U.S. state with market trends to strategize effectively. A must-have for every industry player!