Introduction

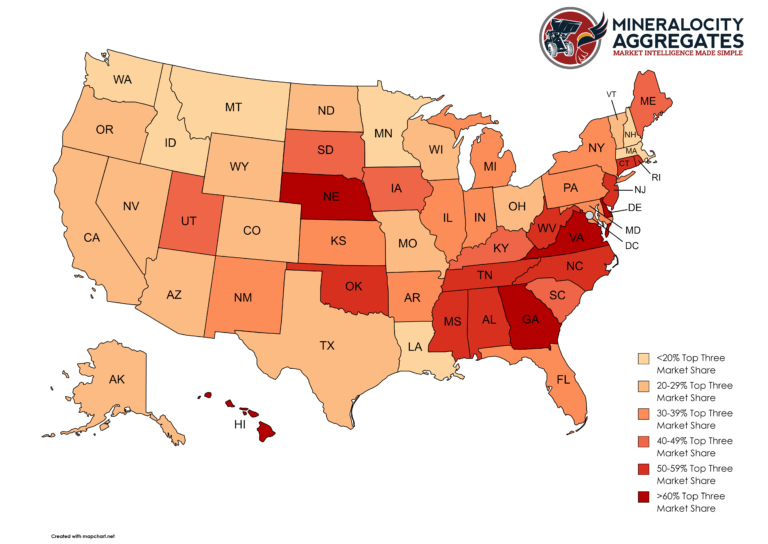

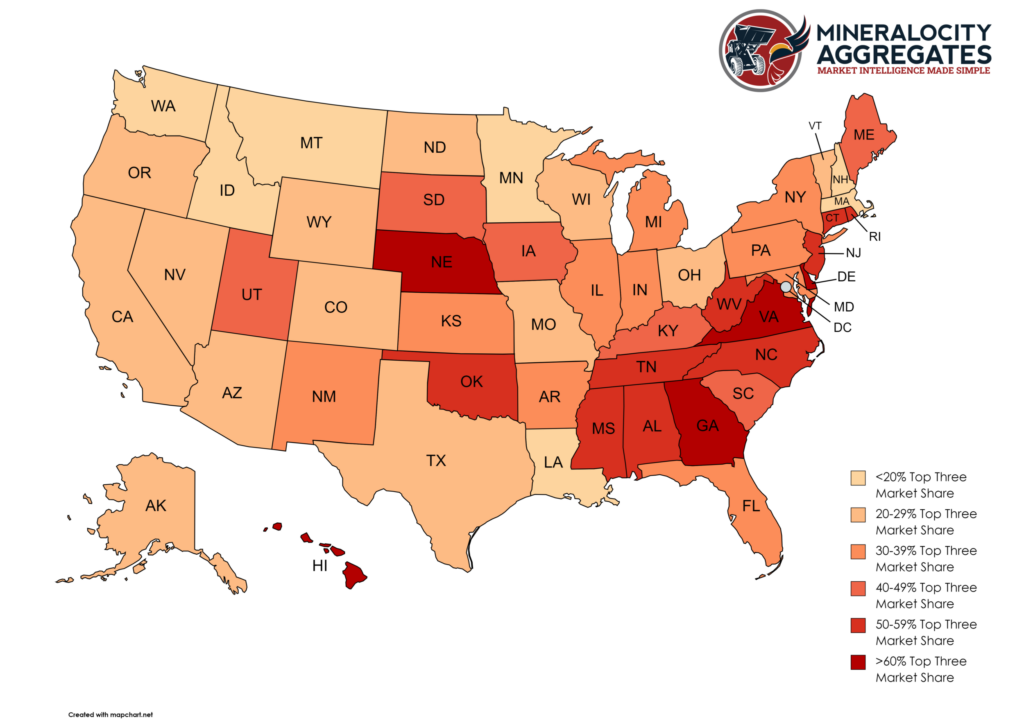

When it comes to the construction aggregate industry, the distribution of market share among leading companies can reveal much about the state of competition, barriers to entry, and opportunities for innovation. Using exclusive and proprietary data from Mineralocity Aggregates, this article sheds light on the dynamics of market concentration in the industry across different U.S. states. Specifically, we examine the contrast between states with highly concentrated markets—dominated by a handful of key players—and those with more fragmented landscapes.

High Concentration Markets in the Construction Aggregate Industry: The Few Rule the Many

Case Study: Hawaii

In Hawaii, the top three construction aggregate producers—HC&D, LLC, Hawaiian Cement, and West Hawaii Concrete—collectively hold a staggering 90% of the state’s market share. This level of concentration not only demonstrates the grip these companies have on the market but also raises questions about barriers to entry for new players.

Case Study: Nebraska

Similarly, in Nebraska, Martin Marietta Materials, Inc., Kerford Limestone Company, and CRH PLC control 77% of the market. Such a tight grip by a few companies often leads to fewer choices for consumers and could potentially affect pricing strategies.

Case Study: Rhode Island

In Rhode Island, J.R. Vinagro Corporation, Holliston Sand Company Inc, and CRH PLC dominate 58% of the market, again pointing toward high concentration. Here, the influence of these key players is evident not just in their market share but also in their capacity to shape industry trends and practices.

Fragmented Market Concentration in the Construction Aggregate Industry: The Many Rule Themselves

Case Study: Alaska

On the other end of the spectrum, Alaska’s construction aggregate market presents a contrasting picture. Here, the top three producers—Colas S A, Anchorage Sand & Gravel Company Inc, and Brice Incorporated—capture just 24% of the market. This low concentration suggests a more open market landscape, where smaller players can compete more effectively.

Case Study: Minnesota

In Minnesota, the three leading companies—Holcim Group, Martin Marietta Materials, Inc., and MDU Resources Group Inc—account for a mere 12% of the market. Such a fragmented market often encourages innovation and competition, offering more choices to consumers.

Case Study: Montana

Montana mirrors this trend with MDU Resources Group Inc, United Materials of Great Falls, Inc., and Fisher Sand & Gravel Company also holding only 12% of the market share. These statistics indicate that there are likely fewer barriers to entry and possibly more room for disruptive innovation in the state.

Conclusion

Market concentration in the construction aggregate industry across the U.S. is a tapestry of concentrated and fragmented markets, each with its own unique challenges and opportunities. While highly concentrated markets may present fewer opportunities for new entrants, they often indicate a level of stability that could be attractive to investors. On the other hand, fragmented markets could be hotbeds for innovation and diversification.

Whatever the level of market concentration in the construction aggregate industry, understanding these dynamics is crucial for anyone involved in the industry. For those looking for more in-depth analysis, the full report, available for free download, provides comprehensive insights to help you explore growth opportunities, enhance operations, and boost profitability in this demanding market.

Unlock exclusive, groundbreaking market data with the 2022 Top Aggregate Producers Report. Don't miss out!

Gain a competitive edge with our 2022 Top Aggregate Producers Report! Get exclusive market share data on top producers in each U.S. state with market trends to strategize effectively. A must-have for every industry player!