Navigating the competitive landscape of the construction aggregate industry means being prepared for a multitude of challenges, from new competitors to economic shifts and beyond. Understanding these traditional threats to your market share is vital for long-term success. This article outlines some of these key factors and offers strategies to help you maintain and grow your market share.

The New Kid on the Block: Handling Fresh Competition

The arrival of a new competitor in the construction aggregate industry can significantly impact your business, potentially eating into your market share. These newcomers often come armed with aggressive pricing strategies, innovative products, or even a unique marketing approach, designed to lure away even your most loyal customers.

Recognize the Threat Early On

The first step in effectively countering new competition is recognizing their presence as early as possible. This can be accomplished through consistent market research, watching for permitting applications, monitoring industry publications, and even keeping an ear to the ground among your customer base and suppliers.

Conduct a Competitor Analysis

Once you’ve identified a new player in the field, a detailed competitor analysis is essential. This will help you understand their strategies, strengths, weaknesses, and most importantly, their potential impact on your market share. Your SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis should be updated to include this new competitor. This will help you identify any adjustments needed in your own value proposition.

Review and Adjust Your Value Proposition

Based on your SWOT analysis, review your value proposition to identify how you can differentiate your offering from the new competitor. This might involve enhancing product features, revising pricing structures, or improving customer service. It’s crucial to remind your customers why they chose your brand in the first place.

Monitor and Adapt

The market conditions are ever-changing, especially with a new competitor stirring the waters. Continuously monitor their strategies, customer feedback, and their impact on your market share. This is a dynamic process that will likely require you to adapt your own strategies over time.

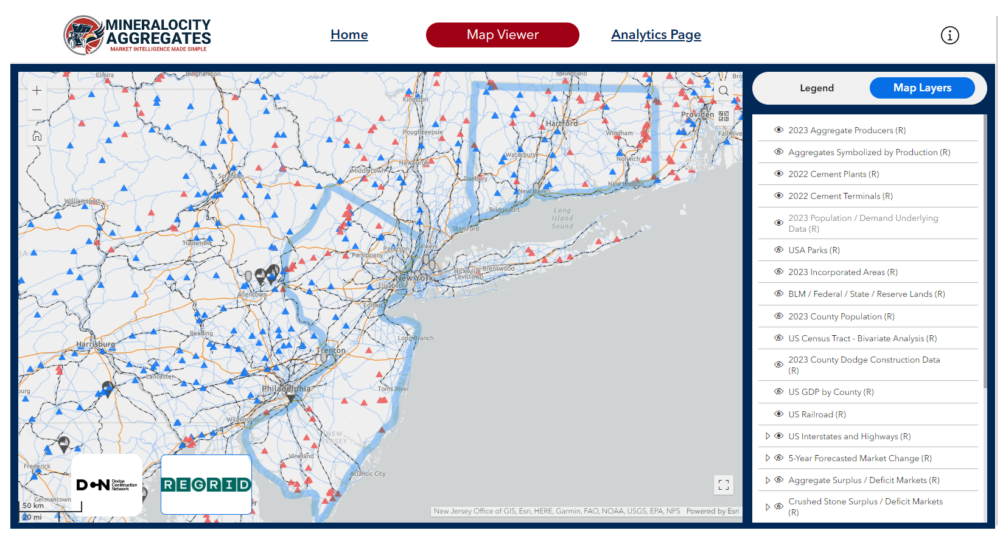

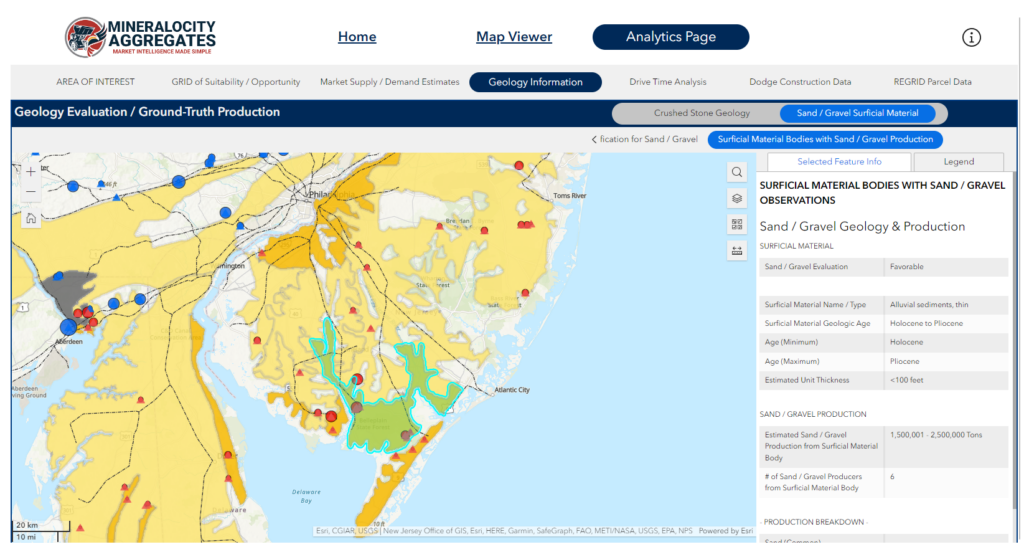

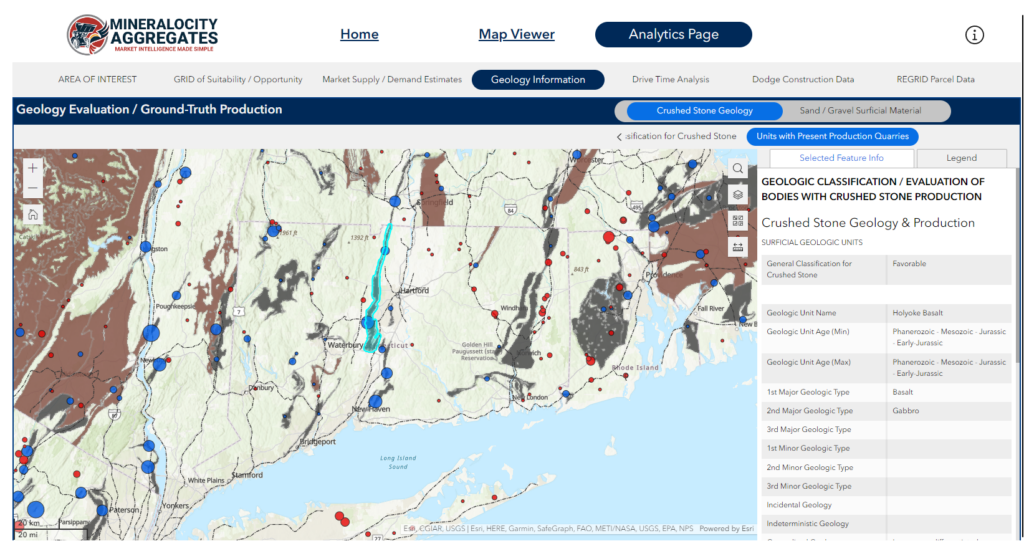

Leverage Data Analytics

Platforms like Mineralocity Aggregates can provide data-driven insights into customer behavior, supply chain dynamics, and market trends. Utilize this data to adapt and refine your strategies for defending your market share against new competitors.

By understanding the strategies and tactics of new entrants, and responding proactively, you can mitigate the impact on your market share and even discover new opportunities for growth.

A Shaky Economy: Weathering Financial Storms

Local and regional economic conditions can dramatically affect your market share in the construction aggregate industry. Economic downturns often lead to reduced construction activities, while booms can bring about increased competition and higher operational costs. Here’s how to safeguard your market share during such uncertain times.

Recognize the Economic Indicators

Be proactive in monitoring key economic indicators relevant to your industry. These might include interest rates, unemployment levels, and construction starts. Understanding these indicators can help you predict how market demand will be affected.

Flexible Business Model

In times of economic instability, a rigid business model can be a liability. Flexibility allows you to quickly adapt to changing circumstances, whether it’s adjusting production levels, diversifying product offerings, or temporarily scaling back on certain operations.

Cash Flow Management

Maintaining a healthy cash flow is crucial, especially during economic downturns. Consider renegotiating terms with suppliers or exploring alternative financing options to bolster your liquidity. This financial cushion can provide you with the room to maneuver when times get tough.

Optimize Costs

Cost optimization is not merely about cutting expenses; it’s about making your operation leaner and more efficient. This might include improving operational efficiencies or renegotiating contracts with suppliers. Any savings can be redirected to strategies aimed at maintaining or increasing market share.

Risk Mitigation Strategies

Utilize risk management tools and strategies to prepare for potential financial downturns. This could include securing long-term contracts with favorable terms or hedging against market variables that could affect your costs, such as fuel prices.

Data-Driven Decision Making

Utilize data analytics platforms like Mineralocity Aggregates to gain insights into customer behavior, pricing elasticity, and market trends. This enables you to make informed decisions and develop adaptive strategies that can weather economic fluctuations.

By being prepared and adaptive, you can better defend your market share when economic conditions shift. Uncertain times often bring both challenges and opportunities—being agile and prepared can help you capitalize on the latter.

Project Tides: Navigating Shifts in Demand

The construction aggregate industry often faces dramatic fluctuations in demand due to the cyclical nature of large construction projects. Whether it’s the commencement of a massive infrastructure project or the winding down of a long-term development, these shifts can significantly affect your market share. Here’s how to stay ahead:

Early Intelligence Gathering

Staying informed about local and regional construction activities is essential. Subscribe to industry journals, participate in local business forums, and maintain relationships with key players to gather early intelligence about upcoming projects or project completions.

Stockpile Management

When you anticipate an increase in demand due to an upcoming project, effective stockpile management becomes critical. You may need to ramp up production in advance to meet this demand, which will also necessitate calculating storage costs and considering the shelf-life of your aggregates.

Scalable Operations

When faced with a sudden influx of large projects, your operation must be scalable. This could mean leasing additional machinery, hiring temporary labor, or partnering with other producers. Scalability allows you to capitalize on increased demand without overextending your resources.

Pricing Strategy Adjustments

Large projects might require bulk quantities but at more competitive pricing. Revisiting your pricing strategy in such cases is crucial. Offering tiered pricing or early-bird discounts can not only secure a large project but also protect your market share.

Post-Project Transition Plans

As large projects wind down, demand for aggregates will drop, sometimes significantly. Having a transition plan can help you adjust your production levels and shift your focus to other markets or smaller projects. Failing to prepare for this drop in demand can result in overstock and reduced profitability.

Data Analytics for Demand Forecasting

Platforms like Mineralocity Aggregates can offer invaluable insights for predicting future demand patterns. Utilizing predictive analytics helps you prepare for market fluctuations, allowing you to make well-informed decisions regarding production, pricing, and distribution.

By staying proactive and adaptable, you can navigate the often unpredictable tides of project-based demand, defending and even growing your market share in the process.

Conclusion: Defending and Expanding Your Market Share Amidst Traditional Threats

In a constantly evolving landscape like the construction aggregate industry, defending your market share is a never-ending task. The threats are many and varied—from new competitors disrupting the market to economic uncertainties that can shake even the most stable of businesses. On top of that, the very nature of the industry is such that demand can ramp up or plummet based on the ebb and flow of large construction projects.

Adaptability and proactivity are your best allies in such an environment. Keeping an eye out for new entrants can help you maintain your competitive edge. During uncertain economic times, a well-honed financial strategy is your best defense, helping you to survive and even thrive. Similarly, understanding the dynamics of demand, particularly during the launch or conclusion of major projects, allows for smarter stockpile management, more dynamic pricing strategies, and a better-planned operational scale.

The thread that weaves all these strategies together is data. Advanced analytics platforms like Mineralocity Aggregates offer crucial insights that can shape your strategies and decisions. These platforms allow you to predict trends, understand market dynamics, and tailor your operations in a manner that not only defends your current market share but sets the stage for future growth.

In the end, the key to successfully defending and expanding your market share lies in your ability to be proactive rather than reactive. Strategies must be continuously reviewed, plans regularly updated, and your finger always kept on the pulse of industry shifts and changes.

If you’re eager to get even more insights into defending your market share, consider booking a free demo today to learn more about the Mineralocity Aggregates platform and how you can immediately leverage its powerful insights in your business!