1. The Imperative of Data-driven M&A Decisions

In today’s rapidly evolving aggregates landscape, merely relying on historical trends or gut instinct is no longer sufficient. The stakes are higher, with the marketplace becoming increasingly saturated and competitive. The need for data-driven M&A decisions has become more than just a recommendation—it’s an imperative.

Every merger or acquisition carries with it a potential for great reward but also inherent risks. Traditional approaches to M&A, while seasoned with experience, might miss nuances in market shifts, consumer behavior, or even geopolitical factors affecting the aggregates sector. It’s in these intricacies that data-driven strategies prove their worth.

Furthermore, the explosion of data sources in recent years has democratized access to insights. From industry reports to social sentiment analysis, there’s an abundance of information available to those willing to harness it. By making data-driven M&A decisions, companies can tap into these vast reservoirs of knowledge, ensuring that their strategies are not only informed but are also agile and adaptable to changing conditions.

The shift towards a more analytical approach is also a nod to the growing demand for accountability and transparency in business operations. Shareholders, stakeholders, and even employees expect decisions to be backed by evidence and logical reasoning. Embracing data-driven M&A decisions meets this expectation head-on, offering a structured, quantifiable approach to growth and expansion in the aggregates sector.

2. Harnessing Advanced Analytics for Strategic Planning

Strategic planning in the world of aggregates is no small feat. With a plethora of variables to consider, from market dynamics to geographical constraints, the margin for error can be thin. Here’s where harnessing advanced analytics for strategic planning comes into play, offering businesses the edge they need in their M&A pursuits.

Traditionally, M&A strategies were crafted using a mix of expert insight, past experiences, and broad market analysis. While these components remain vital, they now form just a part of the puzzle. In our digital age, advanced analytics provide a multidimensional view of potential acquisition targets. They shed light on patterns, opportunities, and potential pitfalls that might escape even the most discerning eye.

Consider, for instance, the vast amount of unstructured data that businesses generate daily. Social media chatter, customer reviews, and even satellite imagery can offer insights into the operational efficiency, reputation, and potential of an aggregate site. Harnessing advanced analytics means turning this sea of data into actionable insights that can guide your M&A decisions.

Moreover, as the aggregates sector becomes increasingly global, understanding regional nuances becomes crucial. Advanced analytics can help pinpoint regions where demand is burgeoning, or identify territories where local regulations might pose challenges. By integrating data-driven M&A decisions into this mix, businesses can craft strategies that are not only responsive but are also predictive, giving them a step ahead of the competition.

3. Due Diligence: Leveraging Data for Informed Analysis

Due diligence has always been the cornerstone of any successful M&A venture. However, with the changing dynamics of the aggregates industry and the explosion of available data, the paradigm has shifted. Leveraging data for informed analysis during due diligence is no longer just an advantage; it’s a necessity.

In the past, due diligence might have involved a few site visits, some financial vetting, and perhaps a few expert consultations. While these practices are still paramount, the landscape has expanded dramatically. With the power of data-driven M&A decisions, businesses can now delve deeper, unveiling aspects of a potential acquisition that were previously obscured.

For example, consider the importance of environmental assessments in today’s aggregates sector. Beyond ensuring compliance with regulations, these assessments, when backed by comprehensive data analysis, can predict future compliance challenges or opportunities for sustainable operations. This kind of foresight can make the difference between a successful acquisition and one riddled with unforeseen complications.

Furthermore, customer sentiment, operational histories, and market penetration are just a few of the areas where data can provide invaluable insights. Through robust analytics tools, businesses can create a holistic profile of a potential acquisition, ensuring that the investment aligns with their long-term strategic goals.

In essence, data is transforming the due diligence process from a reactive exercise into a proactive strategy. By embracing data-driven M&A decisions, businesses in the aggregates sector can ensure that their investments are sound, strategic, and poised for success in an increasingly competitive market.

4. Post-acquisition Integration: Using Data to Smooth the Transition

Post-acquisition integration is, in many ways, the true test of an M&A’s success. While the process of vetting and purchasing might be complete, the real challenges often emerge during the merging of two distinct entities. Data-driven M&A decisions play a pivotal role during this critical phase, ensuring that the integration process unfolds seamlessly.

An acquisition, irrespective of its size, brings together different corporate cultures, operational methodologies, and customer expectations. Without a strategic framework, this union can become disjointed, leading to inefficiencies or even conflicts. This is where the power of data comes into play.

By utilizing data analytics, businesses can identify overlapping functions, potential bottlenecks, and areas requiring immediate attention. For instance, analyzing the operational data of both entities can highlight redundant processes that can be streamlined for efficiency.

Moreover, data can also provide insights into employee sentiments and potential cultural clashes. Proactively addressing these challenges, informed by data, ensures a smoother transition for all involved. A happy workforce is often more productive, leading to better post-acquisition outcomes.

Furthermore, when it comes to customer retention and satisfaction, data-driven insights can be a game-changer. By understanding customer preferences, histories, and expectations, the merged entity can craft strategies that cater to their needs, ensuring continuity and minimizing disruptions.

In conclusion, the post-acquisition phase, while challenging, can be navigated with precision and foresight with the aid of data-driven M&A decisions. By making data the cornerstone of integration efforts, businesses can ensure a smoother, more harmonious, and ultimately more successful union.

5. The Future of M&A: Predictive Analytics and AI

As we hurtle towards a future defined by technological innovation, it’s evident that data-driven M&A decisions are poised to be more advanced and accurate than ever before. With the advent of predictive analytics and artificial intelligence (AI), the aggregates sector can tap into a wellspring of insights that go beyond traditional data analysis.

Predictive analytics, as the name suggests, doesn’t just provide insights on past and present operations but forecasts future trends and possibilities. In the realm of M&A, this means that companies can have foresight into how a potential acquisition might perform in the future, based on varying market conditions and internal changes. This ability to ‘look into the future’ ensures that mergers and acquisitions are not just based on present profitability but on sustainable long-term gains.

On the other hand, AI takes data-driven M&A decisions to a whole new dimension. Advanced algorithms can sift through vast amounts of data at unprecedented speeds, identifying patterns and insights that might be overlooked by human analysts. This is particularly invaluable in the due diligence phase, where time is often of the essence.

Moreover, AI can also assist in post-acquisition integration. By analyzing data from both entities, AI can recommend the optimal ways to merge operations, align corporate cultures, and even suggest potential areas of expansion or contraction.

The future of M&A in the aggregates sector is bound to be dominated by data. But not just any data – predictive, forward-looking, and AI-analyzed data. Businesses that recognize and harness this shift early on are likely to be at the forefront of successful and strategic acquisitions.

Conclusion: The Imperative of Data-Driven M&A Decisions

The transformation of the aggregates sector hinges on data-driven M&A decisions. By grounding acquisition strategies in concrete data, businesses not only mitigate potential risks but also ensure that each merger or acquisition is a step toward long-term profitability and growth.

In this evolving landscape, it’s crucial for businesses to be equipped with the right tools and platforms to harness the full potential of data. This is where Mineralocity Aggregates steps in. With a robust suite of analysis tools and a user-friendly interface, Mineralocity Aggregates empowers businesses to make informed decisions that drive success. Whether it’s predictive analytics, market trend analysis, or post-acquisition data integration, our platform stands as an indispensable ally in your M&A journey.

As the future unfolds, it’s those who recognize the power of data, and partner with industry-leading platforms like Mineralocity Aggregates, that will stand tall in the competitive aggregates landscape.

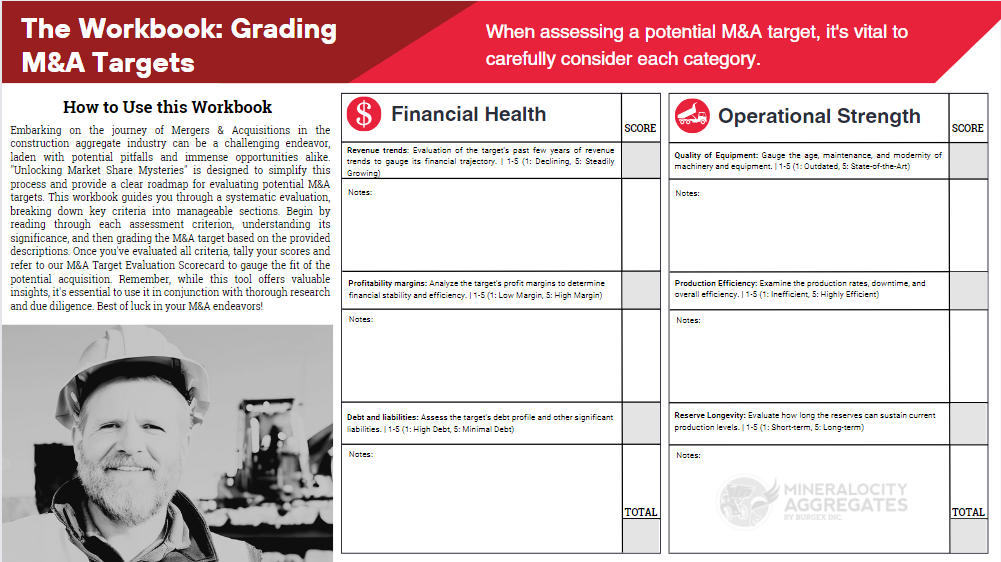

Are You Prepared to Master the Art of Aggregate M&A Target Evaluation?

Unlock the secrets of successful M&A in the aggregates industry with our comprehensive workbook. Packed with actionable insights, best practices, and strategic tools, this guide is your blueprint for making informed, profitable decisions.

Don’t miss your chance to elevate your M&A game—download now!