Explore the top 25 U.S. counties by estimated aggregate demand in 2024. Learn how construction trends, infrastructure investments, and population growth are driving demand for aggregates across key regions.

Contact Us Today

Explore the top 25 U.S. counties by estimated aggregate demand in 2024. Learn how construction trends, infrastructure investments, and population growth are driving demand for aggregates across key regions.

Welcome to the Mineralocity Experience!

At Mineralocity, we believe that data-driven insights are just the beginning. Our platform provides you with the tools you need to start your research and make smarter decisions, but we’re here to take it further. Whether you’re exploring market trends, identifying mining opportunities, or visualizing geological data, Mineralocity is just the start of your discovery process.

If you ever need more in-depth analysis or personalized research, the Burgex team is just an email (info@burgex.com) away. We’re committed to providing you with the support and expertise you need to navigate the complexities of the mining industry and make informed, strategic decisions.

Thank you for being part of the Mineralocity community, where insight meets expertise.

Best regards,

Crystal Burgess

CEO & Co-Founder, Burgex Mining Consultants

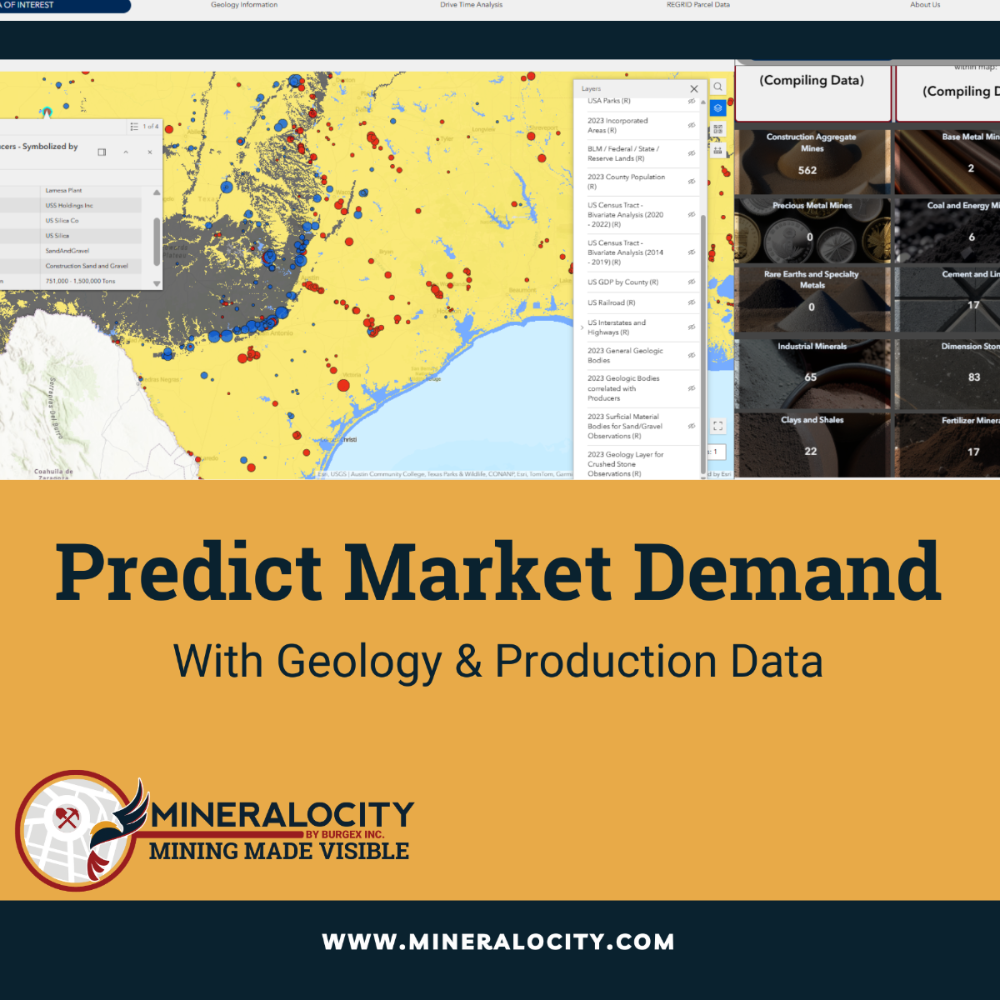

The key to predicting demand is understanding what materials are being mined and at what volume. With Mineralocity, you get real-time geology and production insights to make data-driven business decisions.

🔹 Know What’s Mined Where – Identify quarries and mines producing specific materials relevant to your business.

🔹 Estimate Demand Cycles – Use production estimates for select commodities to predict how often equipment and materials will need replacement.

🔹 Expand into High-Growth Markets – See where production is increasing and target your outreach accordingly.

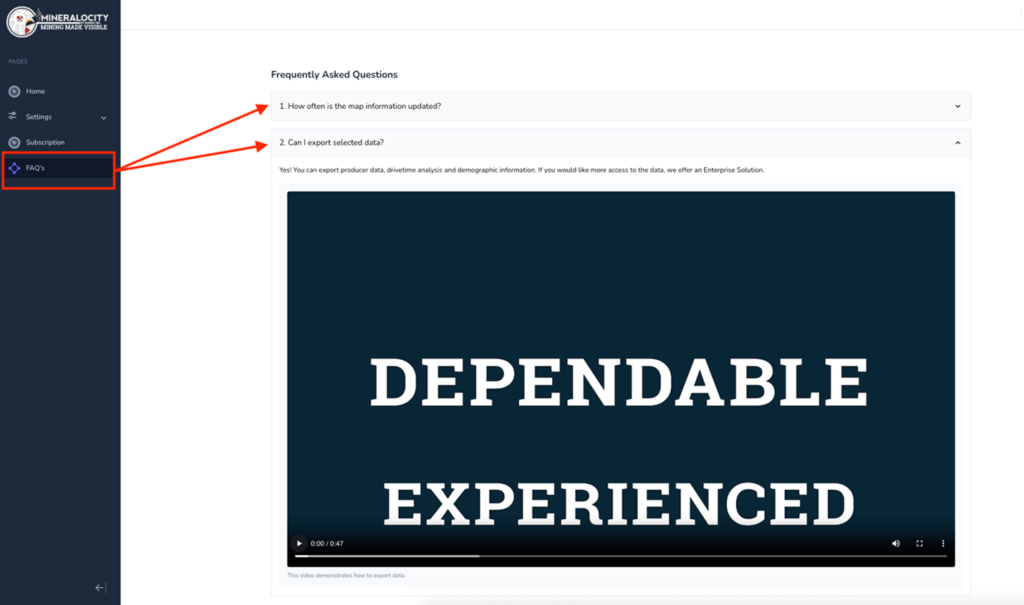

We’re excited to announce that the Mineralocity app now includes a brand-new FAQ section – designed to help you get the most out of your experience.

This section features answers to our most frequently asked questions, along with helpful video tutorials to guide you through troubleshooting common issues. Whether you’re new to the app or just need a quick refresher, the FAQ is your go-to resource for fast and clear support.

Your Partner for Every Stage of Mining and Exploration

At Burgex, we’re more than consultants — we’re your partners in building successful mining and mineral exploration projects.

Our services include:

🔹 Claim Staking & Land Management

🔹 Geological Services

🔹 Exploration Program Management

🔹 GIS Mapping & Analysis

🔹 Aggregate Consulting

🔹 Mine Planning & Engineering Support

With over 150 years of combined experience, we help you navigate every challenge — from early-stage exploration to project development — with precision, efficiency, and expertise.

Let’s build the future of mining together.

Start Your 14-day FREE Trial Today!

As always, reach out to us anytime!

801-648-6463

info@mineralocity.com

As we continue to develop and refine the Mineralocity platform, we’re excited to share the powerful capabilities it offers for both greenfield exploration and high-level market research. Whether you’re looking to gain insight into a new area for mineral discovery or analyze broader market trends, Mineralocity is the tool to help you make data-driven decisions with ease.

As we move forward into another successful quarter, we want to take a moment to reflect on the value we’re committed to providing. At Burgex, we see our relationship with you as more than just service—it’s about sharing knowledge, insights, and resources that empower your success.

What Questions Are You Asking About Your Market?

Using Data To Make Better Decisions