Introduction: The Intersection of Sustainability and M&As

In an era where environmental consciousness and corporate responsibility are at the forefront of business strategies, the potential for sustainable practices in M&As within the construction aggregates industry has never been more critical. Mergers and acquisitions (M&As) aren’t just about financial gain; they’re a golden opportunity to integrate greener, more sustainable practices into operations.

Sustainable Practices in M&As: Operational Synergies

M&As offer a powerful platform for driving operational efficiencies and integrating sustainable practices into the construction aggregates industry. Below are key areas where these synergies manifest:

1. Greening Through Efficiency:

Resource Utilization: By reducing overhead and redundancy, M&As allow companies to streamline operations. This efficient resource utilization reduces waste and promotes sustainability.

Waste Reduction: M&As can enable the adoption of waste recycling and management systems across merged entities, further minimizing environmental impact.

Innovative Technologies: Combining forces allows the integration of cutting-edge green technologies, enhancing efficiency and lessening carbon footprints.

2. Alternative Transportation Methods:

Rail and Barge Access: M&As often provide access to alternative forms of transportation like rail and barge. By moving away from traditional road transport, emissions and fuel consumption can be substantially reduced.

Strategic Location Management: Aligning facilities and operations to optimize transportation modes contributes to a more environmentally friendly logistics approach.

3. Optimizing Drivetimes:

Strategic Route Planning: M&As provide an opportunity to restructure distribution, ensuring that deliveries are made using the shortest and most efficient routes, cutting down fuel consumption.

Technology Integration: Implementing advanced logistics technology, like route optimization software, further enhances drivetime optimization.

Collaborative Distribution: Sharing distribution channels between merged entities reduces travel distances, aligning with sustainable practices in M&As.

4. Renewable Energy Integration:

Shared Renewable Sources: M&As enable companies to combine or invest in renewable energy sources like solar or wind, reducing dependence on traditional energy and lowering carbon emissions.

Energy Management Systems: Integration of smart energy management systems across facilities optimizes energy consumption, promoting sustainability.

5. Water Conservation:

Shared Water Recycling Facilities: Combining operations allows for the potential of shared water recycling and treatment facilities, ensuring responsible water usage.

Water-efficient Technologies: Integration of water-efficient technologies in processes further contributes to water conservation, an essential aspect of sustainable practices in M&As. Mergers give opportunities to upgrade and take a closer look at implementation of more efficient technologies.

Through these operational synergies, M&As in the construction aggregates industry become a pivotal pathway to not only efficiency and cost savings but also to fulfilling social responsibility towards environmental conservation. By capitalizing on the opportunities created by mergers and acquisitions, companies can forge a future where profitability and sustainability coexist.

.

Building Community Relations Through Sustainable Practices in M&As

Enhanced Goodwill: The commitment to sustainability resonates with communities, employees, and customers alike. By integrating green practices, companies can foster goodwill, improve community relations, and boost their overall reputation.

Regulatory Compliance: Emphasizing sustainability often aligns with local and global environmental regulations. M&As offer an opportunity to bring practices up to code or even exceed regulatory standards, creating a competitive advantage.

Cost Savings and Profitability: Sustainable Practices in M&As

Energy Efficiency: Combining operations allows for energy optimization. Sharing resources and implementing energy-efficient technologies lead to substantial cost savings, contributing to both the bottom line and the environment.

Sustainable Materials and Procurement: Utilizing sustainable materials and employing responsible procurement strategies can result in long-term cost benefits. M&As provide the scale necessary to make these practices viable and impactful.

Conclusion: Sustainability as a Strategic Asset in M&As

The integration of sustainable practices in M&As is more than an environmental goal; it’s a strategic asset. From cost savings and regulatory compliance to community goodwill and market differentiation, the green advantage elevates the potential of mergers and acquisitions in the aggregates industry.

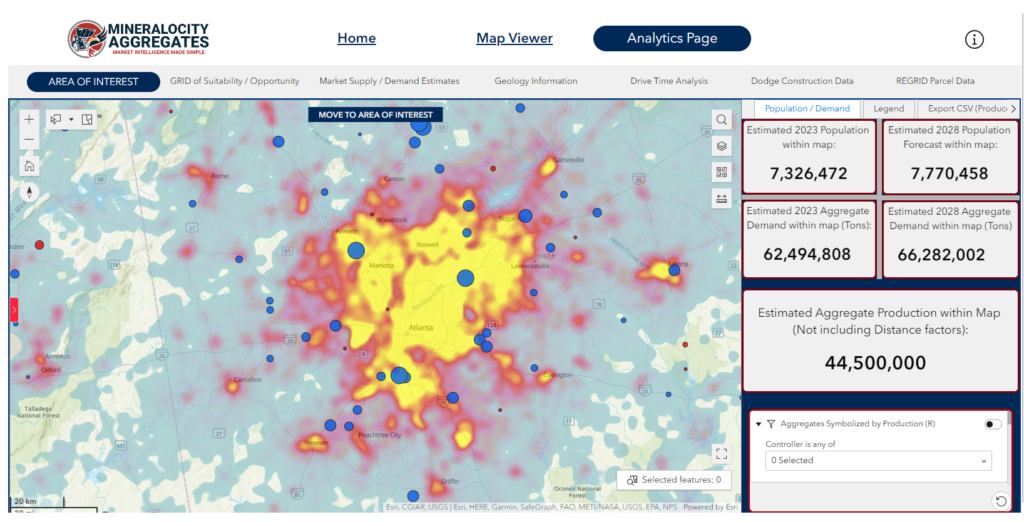

Through the power of Mineralocity Aggregates, uncover the insights and tools you need to navigate the complex landscape of sustainable practices in M&As. Your journey towards a greener future starts with us.

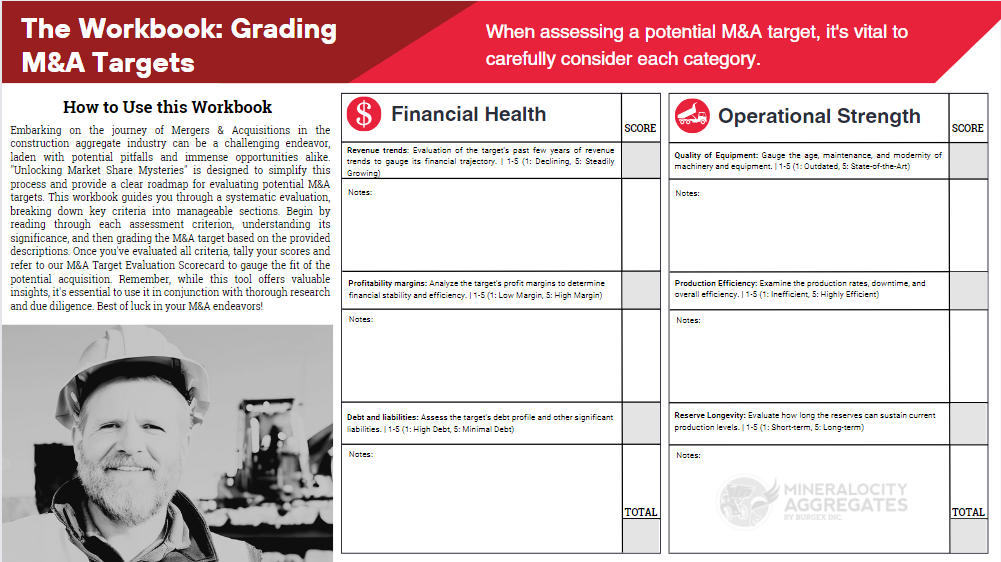

Unlock the secrets of successful M&A in the aggregates industry with our comprehensive workbook. Packed with actionable insights, best practices, and strategic tools, this guide is your blueprint for making informed, profitable decisions.

Are You Prepared to Master the Art of Aggregate M&A Target Evaluation?

Unlock the secrets of successful M&A in the aggregates industry with our comprehensive workbook. Packed with actionable insights, best practices, and strategic tools, this guide is your blueprint for making informed, profitable decisions.

Don’t miss your chance to elevate your M&A game—download now!