Introduction

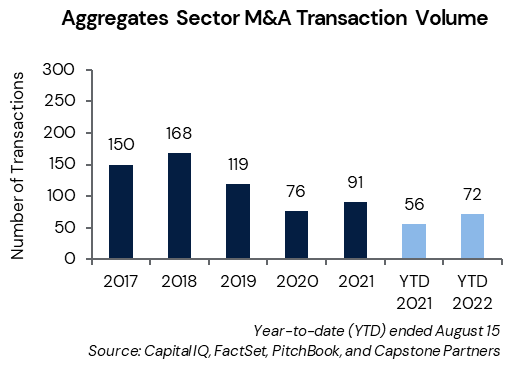

In the dynamic world of the aggregate industry, opportunities for growth and expansion often present themselves in the form of Mergers and Acquisitions (M&A). These strategic moves can be game-changers, propelling businesses to new heights of productivity, market share, and profitability. However, the road to a successful M&A is paved with diligent research, detailed analysis, and strategic decision-making.

Before embarking on an M&A journey, it is crucial to understand the full value of the opportunity that lies ahead. Much like an iceberg, what’s visible on the surface often only represents a fraction of the total picture. The real essence lies beneath the surface – in the company’s operations, customer base, market position, and potential for growth.

This article will serve as your compass in navigating the M&A landscape. It focuses on uncovering the hidden potential and optimization opportunities of an M&A target. Whether you’re a seasoned industry player or a newcomer looking to make a mark, this guide will provide invaluable insights into finding market upside in an M&A opportunity.

By using the tips and strategies outlined in this guide, you’ll be able to assess the true potential of your target, understand its value beyond financials, and position yourself for a successful integration and growth.

In the forthcoming sections, we’ll dive deeper into understanding the value of an M&A opportunity, identifying growth and expansion opportunities, maximizing value from the acquisition, and leveraging advanced tools like Mineralocity Aggregates for efficient market analysis.

So, buckle up and prepare for an enlightening journey towards finding your next big M&A opportunity!

Understanding the True Value of an M&A Opportunity

Just as every person has a unique story, so does every business. A company’s true value extends far beyond its balance sheet, encompassing an array of tangible and intangible assets that contribute to its overall market potential. Recognizing this intrinsic value is a critical starting point when identifying potential growth and expansion opportunities in an M&A deal.

Consider the following areas when assessing a target’s true value:

- Operational Efficiency: How well does the company use its resources? Are there unexploited reserves or underutilized assets that, if better managed, could enhance productivity and profitability? Are there other products that could be produced at the operation that the market demands?

- Market Position: Where does the company stand in its market? Does it have a robust customer base or exclusive contracts that guarantee future sales? Could its market share be expanded with new strategies or investments? Are there opportunities to expand the market, such as potential rail or barge access that aren’t currently being utilized?

- Technological Capabilities: What kind of technology does the company use in its operations? Could implementing more advanced technology, such as data-driven tools like Mineralocity Aggregates, lead to improved performance and market competitiveness?

- Workforce Talent: Does the company have skilled employees who possess valuable industry knowledge? Could their expertise be harnessed to drive growth post-acquisition? Could the company or operation benefit from more experienced management and processes?

- Brand Reputation: How is the company perceived in the market? Does it have a strong brand reputation that could be leveraged for marketing and sales growth? This may not be as important in aggregates as in other industries, but it can have an impact, especially when it comes to interacting with the community.

Every company has hidden assets and unique advantages that, if capitalized upon, could fuel post-acquisition growth. Dig deep into each aspect of the target’s business, unearthing hidden gems of potential that could be polished to perfection with the right strategies.

In the next section, we’ll delve deeper into how to identify growth and expansion opportunities in your M&A target, transforming your acquisition into a catalyst for business growth.

Unleashing Hidden Growth Potential

After evaluating the true value of your M&A target, the next step is to identify areas of growth and expansion that can be realized post-acquisition. This requires a strategic, forward-thinking mindset, as you’ll need to envision the company’s future performance under your management and direction.

Here are several strategies to help you find that hidden potential:

- Expanding into New Markets: Look for opportunities to enter new geographical markets or serve new customer segments. For example, could the aggregate operation serve construction, landscaping, or road building markets that it’s not currently reaching? Are there other products that could be produced that aren’t currently?

- Maximizing Operational Efficiency: Evaluate if existing operations can be optimized for greater efficiency. Could you streamline processes, reduce waste, or enhance productivity with technology like Mineralocity Aggregates? Could this operation be integrated into other nearby operations to created cost savings and other synergies.

- Leveraging Unused Assets: Identify unused assets or resources and brainstorm how they could be put to productive use. This could include underused machinery, unexploited reserves, extra land holdings, or even underutilized staff talents.

- Building Strong Partnerships: Look for strategic partnerships or collaborations that could enhance your market reach or operational capacities. This could include partnering with local builders, joining forces with similar aggregate producers, or establishing contracts with governmental bodies.

- Integrating Advanced Technology: Implement cutting-edge technologies to modernize the operations, improve product quality, and enhance market competitiveness. Mineralocity Aggregates, for instance, offers an expansive suite of features for market analysis, site selection, and operational efficiency that could revolutionize your newly acquired business.

Finding the hidden potential in an M&A opportunity is like mining for gold. It requires patience, dedication, and strategic foresight. But with the right tools and approach, you can uncover opportunities that catapult your new acquisition into a market-leading position.

In the next section, we will explore how Mineralocity Aggregates can assist you in finding these hidden growth opportunities, ensuring your M&A strategy delivers a bedrock of success.

Capitalizing on Opportunities with Mineralocity Aggregates

Now that you have identified the areas of growth and expansion in your prospective acquisition, the next crucial step is to efficiently capitalize on these opportunities. This is where Mineralocity Aggregates can play an instrumental role.

Here’s how our platform can support your M&A strategy:

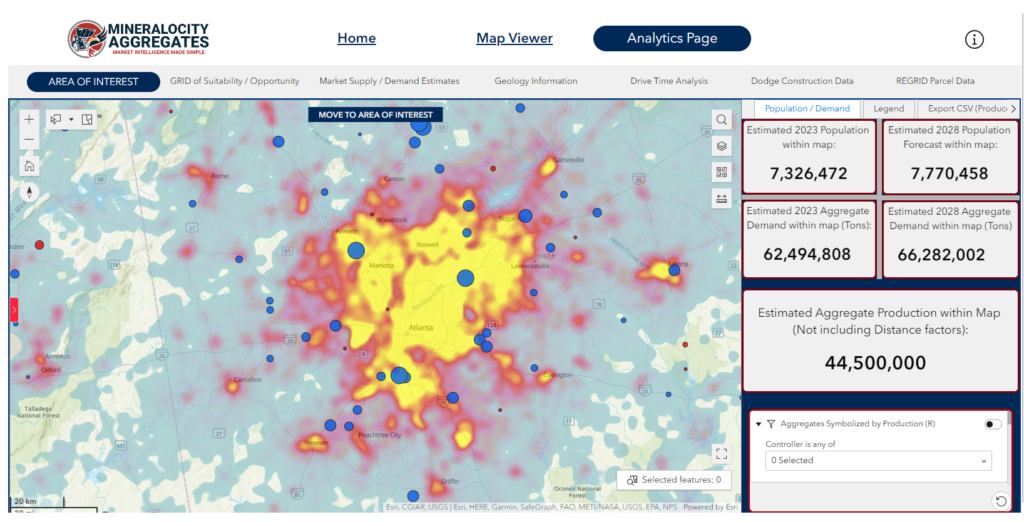

- Comprehensive Market Analysis: Mineralocity Aggregates delivers robust market insights, allowing you to make well-informed decisions. Our platform provides data on construction trends and spending, aggregate demand, and potential customer bases. These insights can enable you to identify new markets, understand your competition, and align your services with market needs.

- Asset Utilization: Mineralocity Aggregates can help you identify and utilize previously overlooked assets. Whether it’s unexploited reserves, underused machinery, or unused infrastructure, our platform can guide you on how to derive value from these assets, especially when utilized to look at markets holistically for strategic planning and development.

- Technological Advancement: The platform’s advanced features, like predictive analysis and real-time data visualization, can help modernize the operations of your new acquisition. These technologies can improve product quality, increase efficiency, and boost competitiveness in the market.

- Strategic Partnerships: With our expansive network in the aggregates industry, we can facilitate strategic partnerships that can enhance your market reach or operational capacity. Built by Burgex Mining Consultants, we’re not just a technology platform; we’re a community of industry leaders.

As you can see, Mineralocity Aggregates is more than just a technology platform; it’s your partner in growth and success. By leveraging the capabilities of our platform, you can realize the full potential of your M&A opportunity, ensuring that your new venture not only thrives but leads the market.

In our final section, let’s explore how to implement these strategies for successful integration post-acquisition.

Successful Post-Acquisition Integration

Successful post-acquisition integration is arguably as vital as the due diligence phase. It’s during this stage where the real work begins to derive value from your new venture. The following steps are crucial in this process:

Establishing Clear Goals: With your identified opportunities from the acquisition, it’s essential to set clear, actionable goals. Whether it’s expanding into a new market, increasing production capacity, or integrating new technologies, having precise objectives will provide a roadmap for your post-acquisition strategy.

Creating an Integration Plan: A detailed integration plan is the blueprint for achieving your goals. This plan should include tasks, timelines, responsible parties, and metrics for success. It’s also crucial to factor in potential risks and mitigation strategies.

Leveraging Mineralocity Aggregates: Our platform can be integral to your integration plan. From facilitating strategic decision-making with comprehensive market data to driving operational efficiencies with our advanced tools, Mineralocity Aggregates can be an invaluable partner in your post-acquisition journey.

Communication and Training: Keep your team informed about the changes and provide them with the necessary training. This not only helps in smooth integration but also ensures that your workforce is equipped to utilize the full potential of Mineralocity Aggregates.

Monitoring and Adjusting: Post-acquisition integration is not a set-and-forget process. Regular monitoring of your progress against set goals is necessary. Equally important is being flexible and ready to adjust your strategy based on the evolving business environment and performance metrics.

The journey of finding market upside in an M&A opportunity may seem complex, but it doesn’t have to be. With careful planning, a strategic approach, and the right tools like Mineralocity Aggregates at your disposal, you can unlock the full potential of your new venture.

Remember, an M&A is not just a transaction; it’s the beginning of a new chapter in your growth story. Make it a successful one.

Conclusion

In conclusion, uncovering the market upside in an M&A opportunity is both an art and a science. It requires a blend of strategic foresight, thorough due diligence, and meticulous post-acquisition integration. While the process may appear daunting, the rewards can be significant, offering unprecedented growth, increased market share, and operational efficiencies.

It’s also important to remember that you’re not alone in this journey. At Mineralocity Aggregates, we’re committed to providing the tools and insights you need to make informed, strategic decisions. Our platform offers data-driven solutions that can simplify your due diligence process, highlight potential growth areas, and even facilitate smoother post-acquisition integration.

As you move forward in your M&A journey, remember this: every acquisition has its challenges, but with careful planning, the right resources, and a clear vision of what you hope to achieve, you’re well on your way to finding the hidden market upside and creating a success story of your own.

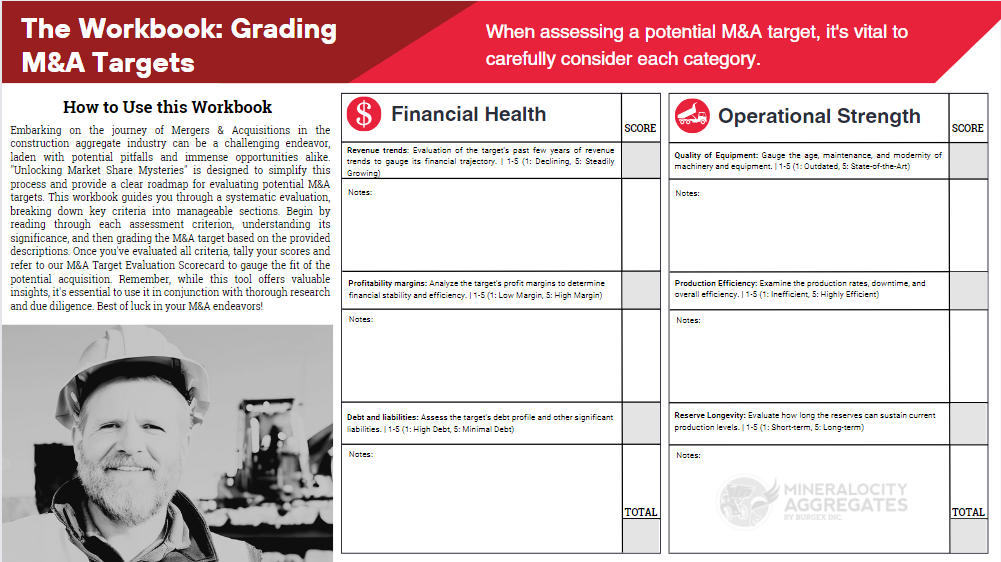

Are You Prepared to Master the Art of Aggregate M&A Target Evaluation?

Unlock the secrets of successful M&A in the aggregates industry with our comprehensive workbook. Packed with actionable insights, best practices, and strategic tools, this guide is your blueprint for making informed, profitable decisions.

Don’t miss your chance to elevate your M&A game—download now!