Navigating the nuances of a local construction aggregate market can seem daunting, especially when you’re unfamiliar with the territory. Yet, the most successful businesses often operate with a localized touch, aligning their strategies to the very specific needs and trends of the communities they serve. To truly compete and thrive, understanding the market like a local player is essential. Here’s how you can get started:

1. Dive Deep Into Regional Consumption Patterns

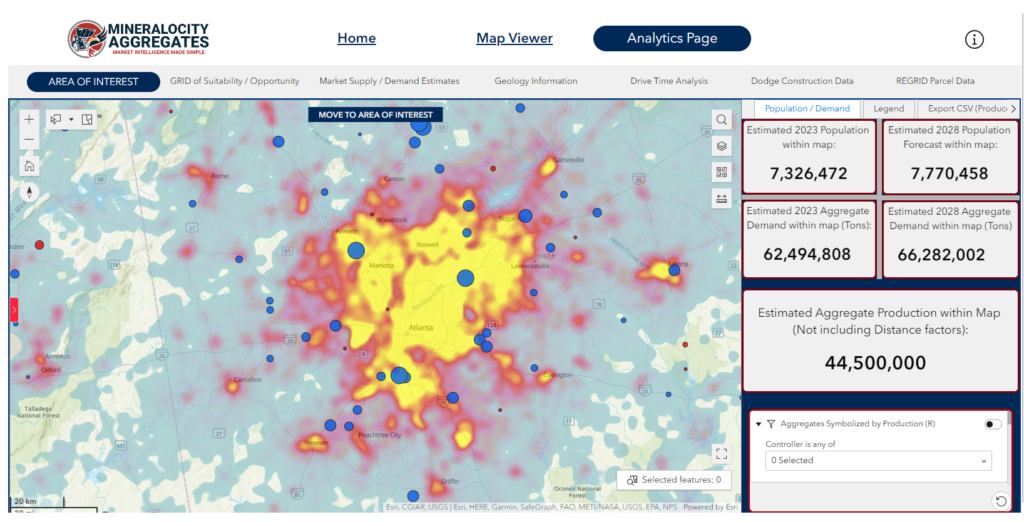

Every locale has its unique patterns of construction aggregate consumption. Urban areas with ongoing infrastructure projects might have different demands than suburban or rural settings. Begin by analyzing per-capita consumption and compare it to broader national averages. Platforms like Mineralocity Aggregates provide insights tailored to specific regions, offering a leg-up in your research.

2. Forge Local Partnerships

Cultivating relationships with local businesses, government agencies, and other community stakeholders can be invaluable. They offer firsthand insights, often giving you a pulse on shifts in demand, regulatory changes, and upcoming large-scale projects. Moreover, partnerships can open doors for collaborative ventures and supply contracts.

3. Understand Local Regulations and Policies

Construction aggregate markets don’t operate in a vacuum. They’re heavily influenced by regional regulations, zoning laws, environmental guidelines, and taxation structures. Familiarize yourself with these rules, and if possible, engage local legal experts who specialize in construction and mining regulations.

4. Engage in Community Initiatives

Being an active participant in community events, fundraisers, or sustainability initiatives not only elevates your brand but also keeps you informed about local sentiments. Through these engagements, you can glean insights about residents’ attitudes towards construction projects, environmental concerns, and other relevant issues.

5. Monitor Competitor Activities

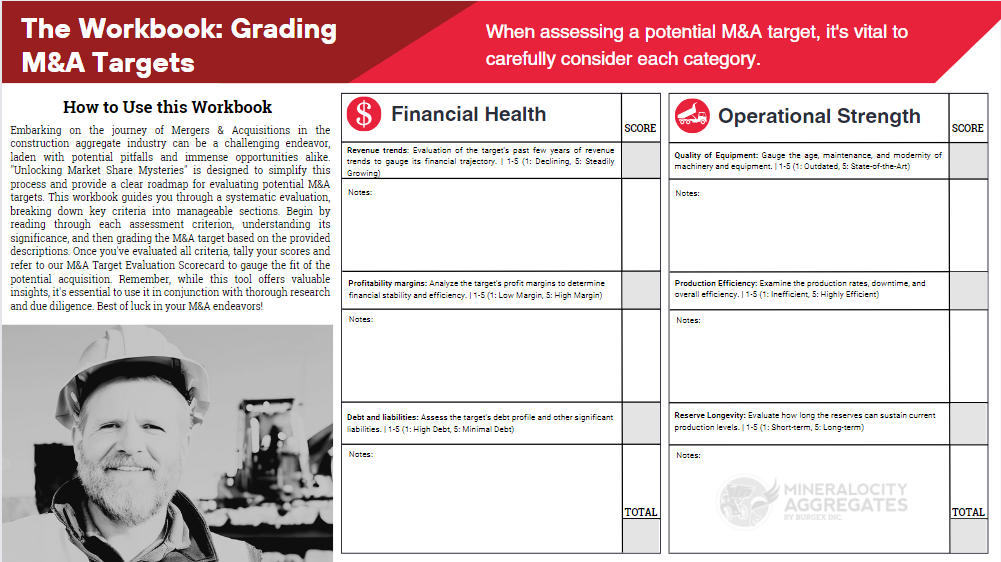

Local competitors often have a deep understanding of the market’s intricacies. Observing their strategies, pricing models, and marketing efforts can reveal key trends and gaps in the market. Moreover, by analyzing their strengths and weaknesses, you can tailor your approach to gain a competitive edge.

6. Invest in Local Talent

Hiring locally provides multiple advantages. Local employees often have ingrained knowledge of the community’s preferences, concerns, and challenges. They can guide decision-making, build trust with local stakeholders, and offer invaluable insights that might not be immediately apparent to outsiders.

7. Leverage Digital Platforms and Analytics

Using platforms like Mineralocity Aggregates ensures you have access to the latest data and market analysis. These platforms provide a comprehensive view of the market, highlighting shifts in demand, consumption patterns, and other pivotal metrics. The data-driven insights they offer can help align your strategies to the local market dynamics.

Conclusion

In the intricate landscape of construction aggregate markets, having a local player’s insight can significantly influence your success. It enables you to make informed decisions, foster community relationships, and respond proactively to shifts in demand and preferences. Embrace these strategies, and you’ll be well on your way to not just understanding but mastering the local market dynamics. Remember, platforms like Mineralocity Aggregates are your partner in this journey, equipping you with the tools and insights you need every step of the way.

Unlock exclusive, groundbreaking market data with the 2022 Top Aggregate Producers Report. Don't miss out!

Gain a competitive edge with our 2022 Top Aggregate Producers Report! Get exclusive market share data on top producers in each U.S. state with market trends to strategize effectively. A must-have for every industry player!