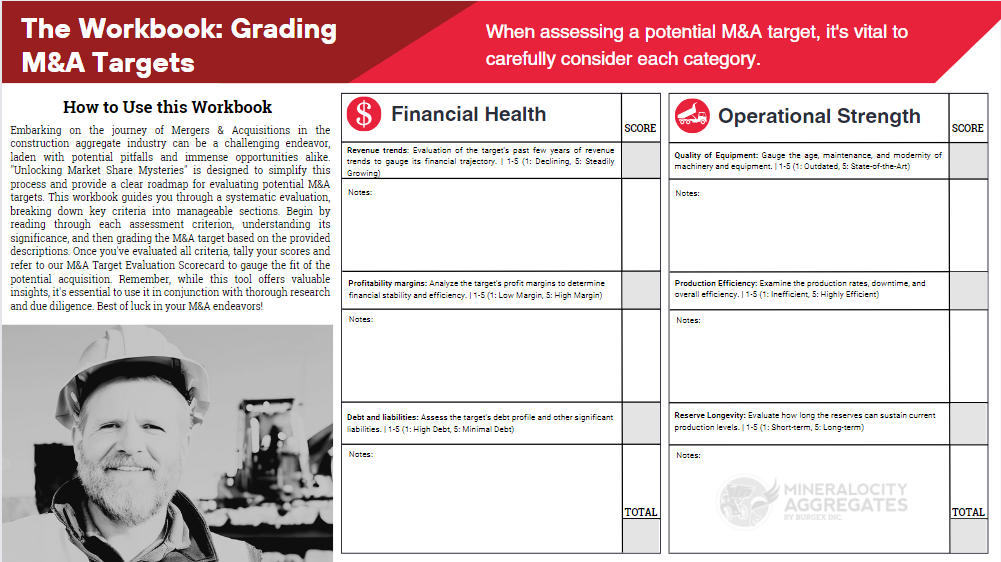

Investing in an aggregate operation holds considerable promise. The industry’s pivotal role in infrastructure development means there’s always potential for profits. Yet, like all industries, the aggregate sector isn’t without its pitfalls, especially for the uninformed investor. The importance of due diligence can’t be overstated, and here’s why.

1. Unexpected Operational Hurdles

Every operation, on the surface, has its way of projecting efficiency and promise. However, delving deeper can sometimes reveal operational issues that can directly impact the return on investment and overall efficiency.

Obsolete Equipment: Without proper examination, you might find that much of the equipment is outdated or frequently malfunctioning. The cost of updating machinery can quickly eat into expected profits.

Sub-Optimal Mine Plans: Even if an operation appears profitable on the surface, a lack of strategic mine planning can lead to inefficient extraction, escalating costs, and diminishing returns.

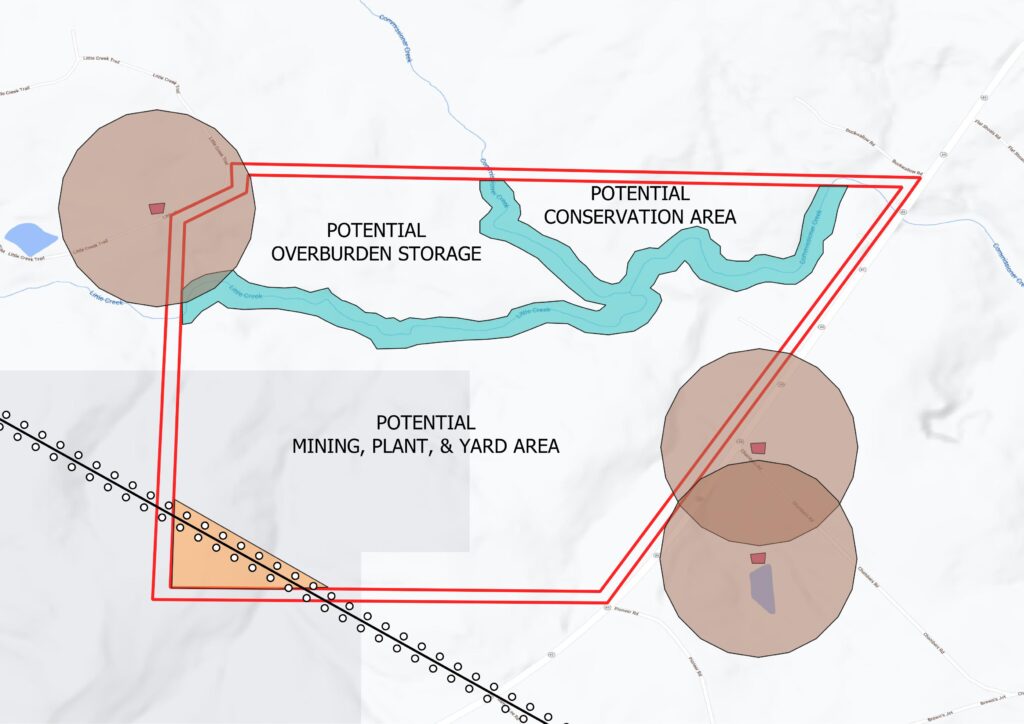

Unexplored Expansion Potential: Without detailed assessment, investors might miss out on understanding the full potential for expansion or additional extraction sites.

Safety Concerns: Overlooking the safety protocols might mean the operation has a history of accidents, which can result in high insurance costs and potential lawsuits.

2. Regulatory and Compliance Surprises

In the world of aggregate operations, the regulatory landscape is intricate. An overlook, intentional or otherwise, on regulatory and compliance matters can lead to significant unexpected costs, legal battles, or even a halt in operations.

Permitting Issues: While the operation might currently be running, they could be doing so without the proper permits or might be near the expiration of their permit without a clear renewal path.

Environmental Concerns: A lax approach to environmental responsibilities might have left the operation open to potential lawsuits or expensive cleanup processes.

Land Reclamation: Not having a clear plan for land reclamation after extraction can result in high unforeseen costs and potential legal implications.

Zoning Restrictions: There might be restrictions on the expansion or the kind of activities that can be carried out, impacting the future growth potential.

3. Inaccurate Valuation

Valuing an aggregate operation isn’t just about crunching numbers. It’s about understanding the geological, operational, and financial intricacies that interplay to provide an accurate picture of the operation’s worth.

Overestimating Reserves: Without thorough geological studies, there’s a risk of overestimating the amount of material available for extraction. This can considerably affect the operation’s long-term profitability.

Hidden Liabilities: Previous accidents, disputes, or unresolved claims can lead to unexpected financial drains.

Underestimating Operational Costs: The operation’s costs might be higher than industry standards, reducing the profit margin.

Debt Load: The operation could have undisclosed or underestimated debts that could affect the profitability and overall valuation.

4. Market Misjudgment

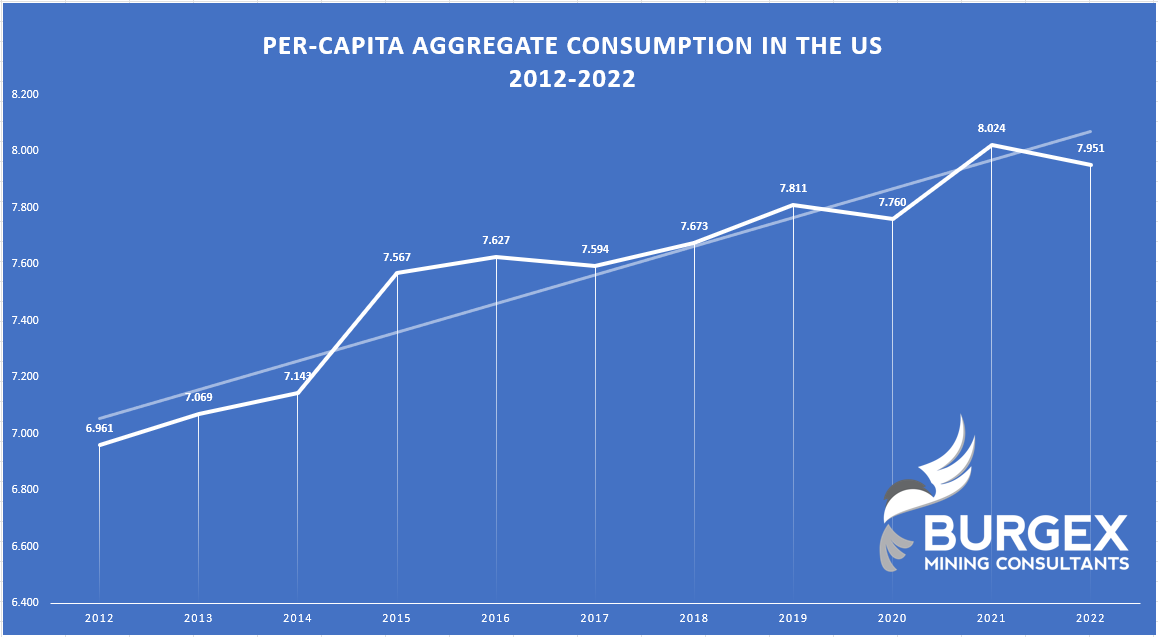

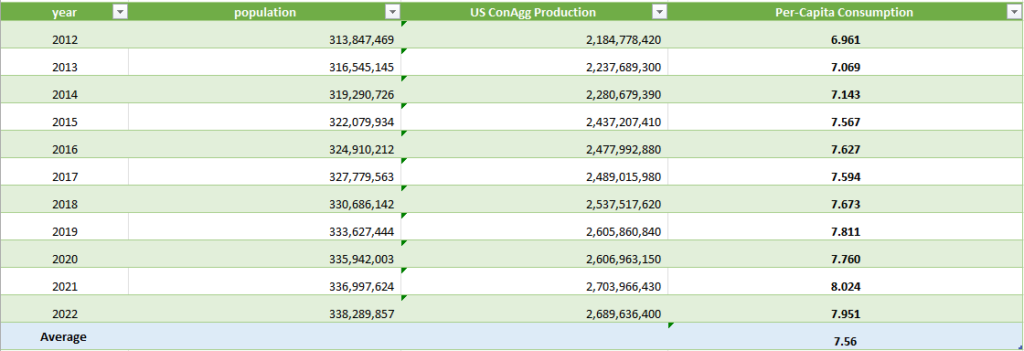

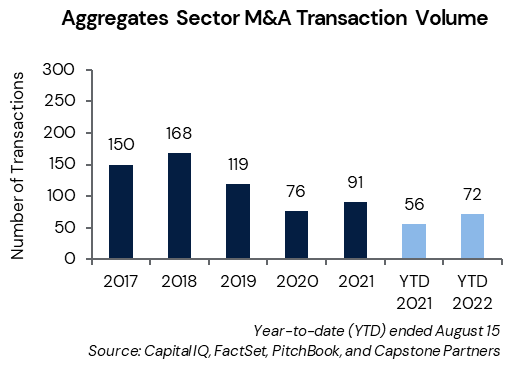

The demand for aggregates doesn’t exist in a vacuum. It’s tied directly to the ebbs and flows of local, national, and global economies, construction trends, and more. A misjudgment in this arena can severely skew profitability projections.

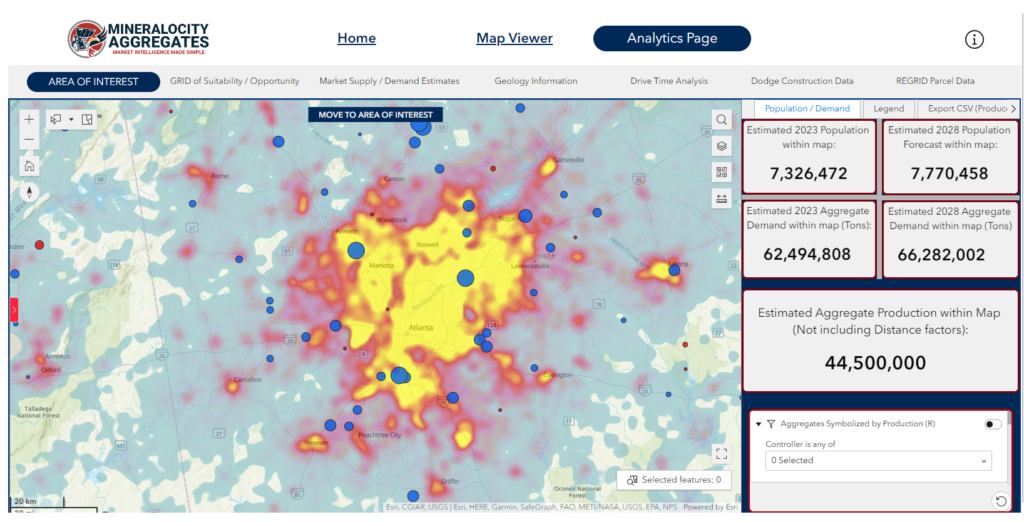

Overestimating Demand: Without proper analysis, there’s a risk of overestimating the local demand for aggregates, leading to surplus production and reduced prices.

Underestimating Competition: Failing to account for the competitive landscape can leave investors blindsided by aggressive competition, affecting market share and profitability.

Shifts in Construction Trends: Changes in construction methods or preferences can influence the demand for specific aggregates.

Economic Downturns: Local or global economic situations can influence construction projects and, subsequently, aggregate demand.

Human Resources and Management Gaps

Behind every successful aggregate operation is a team of dedicated professionals. However, underlying issues in management, team dynamics, or skill levels can introduce instability and inefficiency in the operation.

Skill Shortages: It’s possible that the current team lacks the necessary skills or training to run operations efficiently.

Management Discord: Underlying issues among the management team or between management and staff can result in operational inefficiencies or even halts.

Employee Turnover: High turnover rates can indicate deeper operational or management issues and result in inconsistency in production.

Lack of Succession Planning: Not having a plan for future leadership can jeopardize the long-term stability of the operation.

Conclusion

As enticing as the prospect of investing in an aggregate operation might be, it’s essential to dive deep beneath the surface. The risks of not conducting thorough due diligence are not only varied but can also be financially devastating. Expertise in the form of industry consultants, such as Burgex Mining Consultants, and tools like Mineralocity Aggregates, becomes invaluable in these situations. With their comprehensive knowledge and tools, they ensure that your investment is built on solid ground, minimizing risks and optimizing potential returns.