In the bustling arena of the construction aggregates industry, where competition is fierce and the race for market share is relentless, mergers and acquisitions (M&As) offer a strategic avenue for companies to stand out. But beyond the financial gains and operational synergies often highlighted, M&As have a transformative ability to elevate a company’s brand and reputation. This article delves into the branding and reputation facets of M&As and reveals how these business moves can lead to a stronger market presence and enhanced credibility.

Elevating Aggregate Brand Presence Through Strategic Alignment

When two entities merge or one acquires the other, there’s more at play than just a change in ownership. It’s a fusion of values, visions, and brands. This alignment can significantly boost market presence by:

Unifying Aggregate Brand Messages: Merging with a company that resonates with your values amplifies the impact of the brand message, enabling a coherent and powerful narrative.

Expanding Geographical Reach: Acquisitions can help in penetrating new markets or regions, resulting in a broader customer base and more prominent market positioning.

Enhancing Product Portfolio: The combined strengths of two companies can lead to a more diverse and appealing product portfolio, attracting new segments of customers.

Building Trust and Credibility through Aggregate Branding

Trust and credibility are invaluable assets in the aggregates industry. Through M&As, companies can:

Leverage Established Reputation: Acquiring or merging with a well-regarded entity can provide instant credibility and trust, especially if the acquired company has a long-standing reputation for quality and integrity.

Share Best Practices: Combining the best practices of both entities fosters excellence and consistency in operations, further bolstering reputation.

Create Stronger Stakeholder Relationships: Unified management and clear communication strengthen relationships with stakeholders, leading to lasting trust and collaboration.

Opening Doors to New Opportunities

An enhanced aggregate brand presence and solid reputation do more than just attract customers; they open doors to lucrative contracts, partnerships, and growth opportunities:

Attracting High-Value Partnerships: A strong aggregate brand can attract partnerships with industry leaders, driving innovation and growth.

Securing Lucrative Contracts: Enhanced reputation often leads to more significant and more profitable contracts, cementing the company’s position in the market.

Fostering Customer Loyalty: A unified and well-respected brand resonates with customers, leading to increased loyalty and long-term revenue growth.

Conclusion

Brand Building through M&As isn’t just a strategy; it’s a transformative process that can redefine a company’s position in the market. From unifying brand messages to leveraging established reputations, and opening doors to new opportunities, M&As can be a game-changer in elevating market presence and reputation.

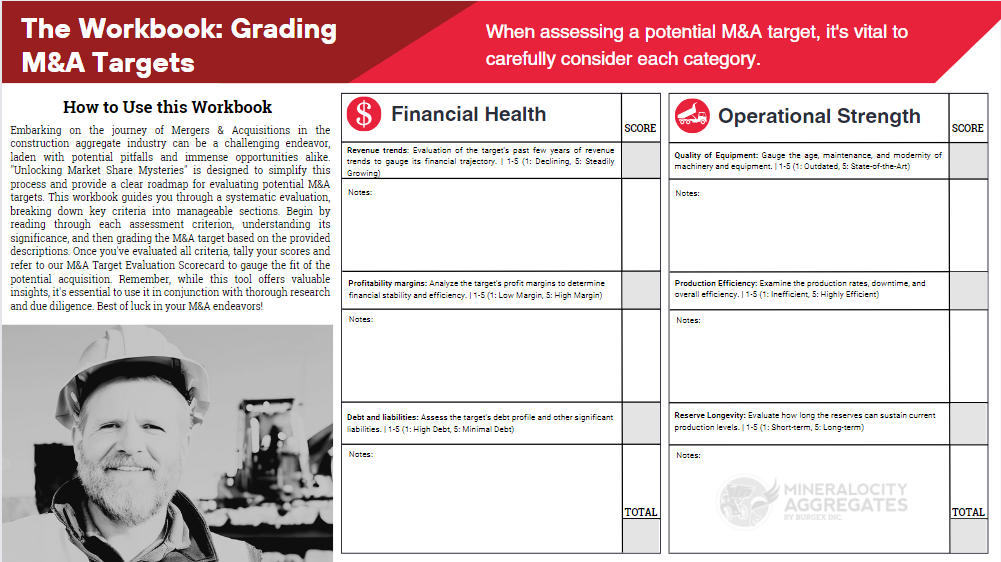

But how does one navigate the intricate dynamics of M&As with finesse and strategic acumen? That’s where Mineralocity Aggregates comes into play. Unlock the secrets of successful M&A in the aggregates industry with our comprehensive workbook. Packed with actionable insights, best practices, and strategic tools, this guide is your blueprint for making informed, profitable decisions. Dive deep into our M&A guide and leverage the power of Mineralocity Aggregates to pave the way for a brighter, more efficient future in the aggregates industry.

Are You Prepared to Master the Art of Aggregate M&A Target Evaluation?

Unlock the secrets of successful M&A in the aggregates industry with our comprehensive workbook. Packed with actionable insights, best practices, and strategic tools, this guide is your blueprint for making informed, profitable decisions.

Don’t miss your chance to elevate your M&A game—download now!