We attend about 20 trade shows per year, including local regional reverse expos. It’s a great chance for us to meet new people, talk with the ones we know, and get a feel for the sentiment around the industry. It’s an investment, but always worth the time and effort it takes.

What we’ve been seeing across all the shows we attend is the sheer amount of new suppliers popping up that have not serviced the mining/quarry industry before. These folks are wide-eyed and bushy-tailed, walking the halls and absorbing as much information as they possibly can.

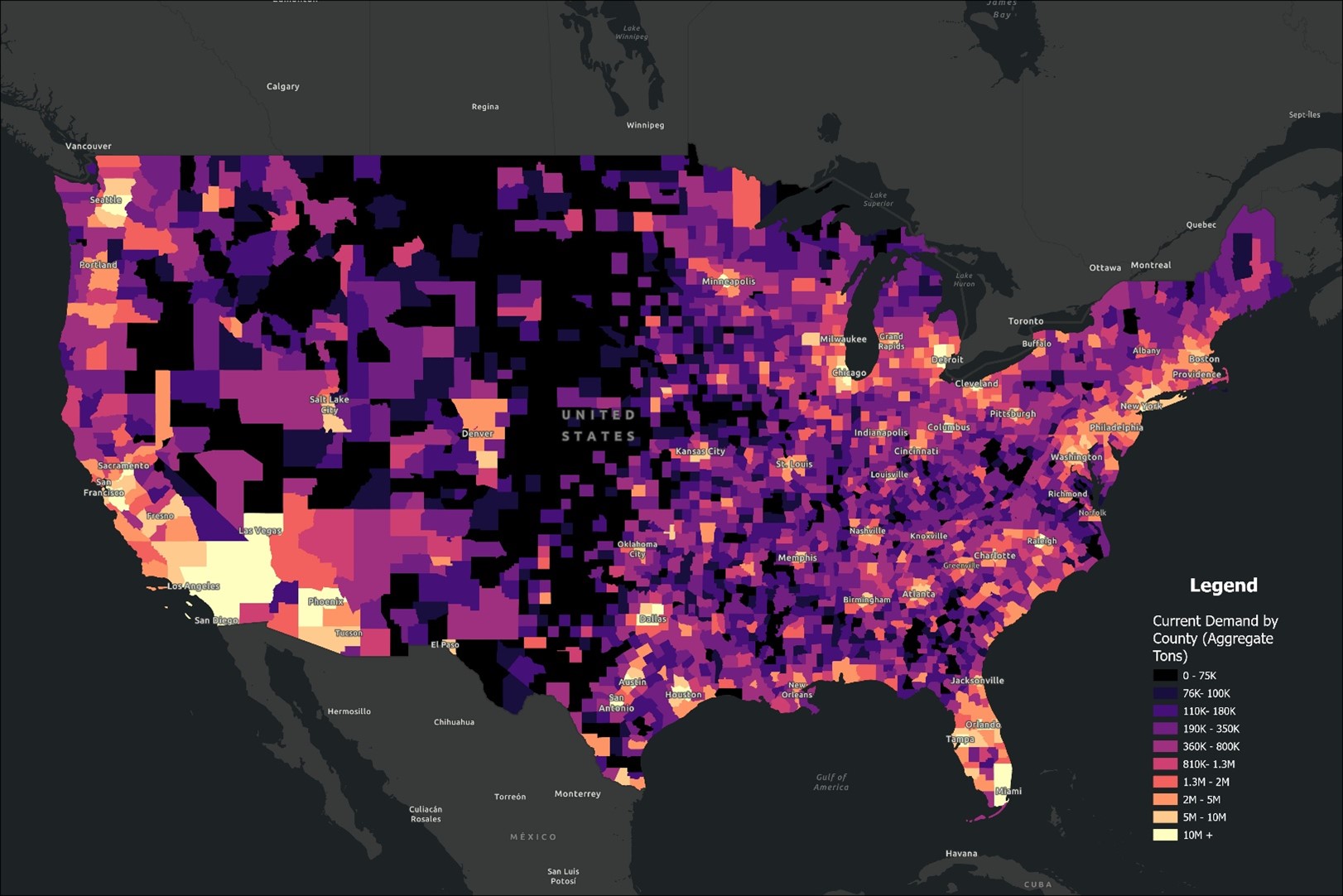

You can see the look in their eyes as they realize there is this massive sector they didn’t know about with thousands of new customers they never realized existed. The amount of new customers seems limitless! And overwhelming.

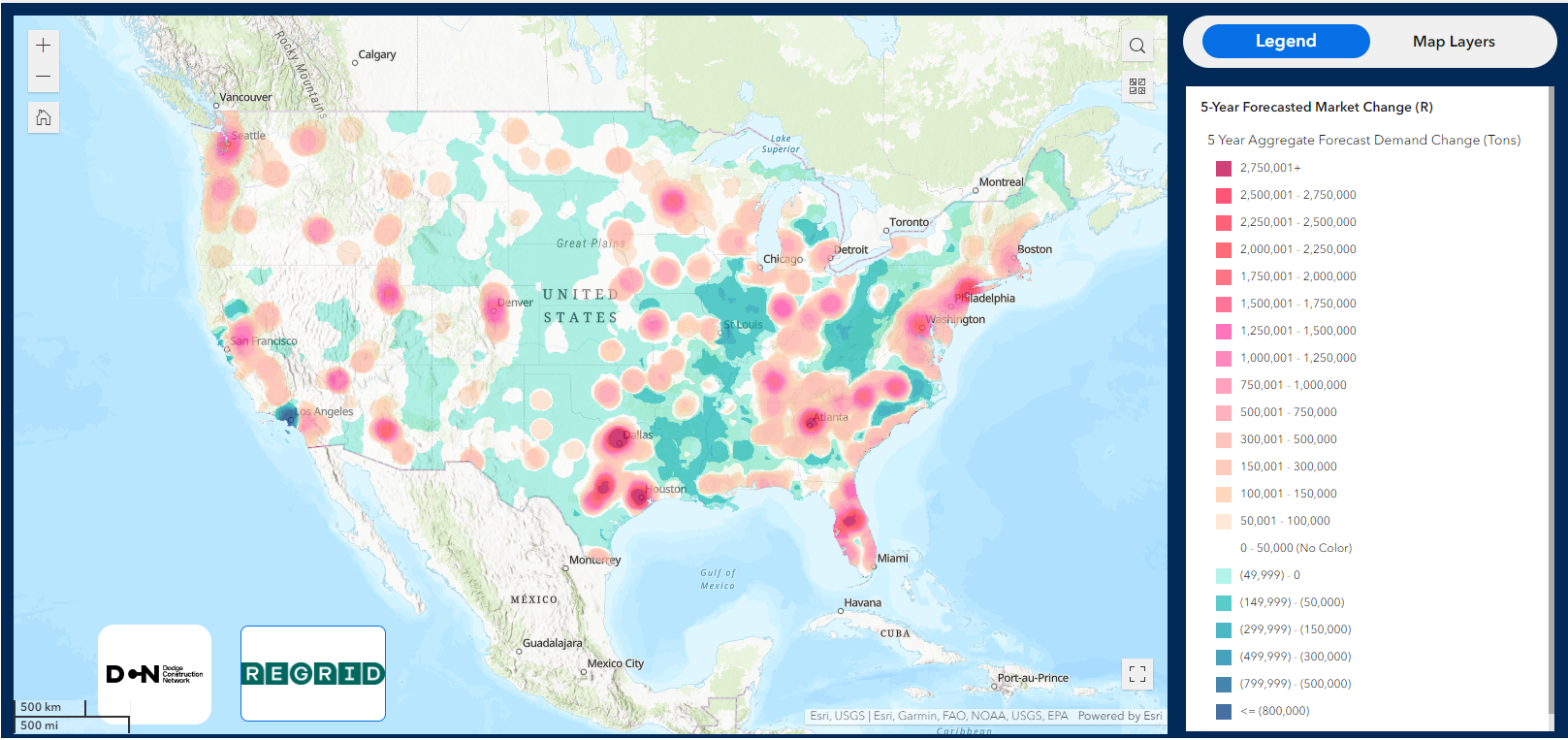

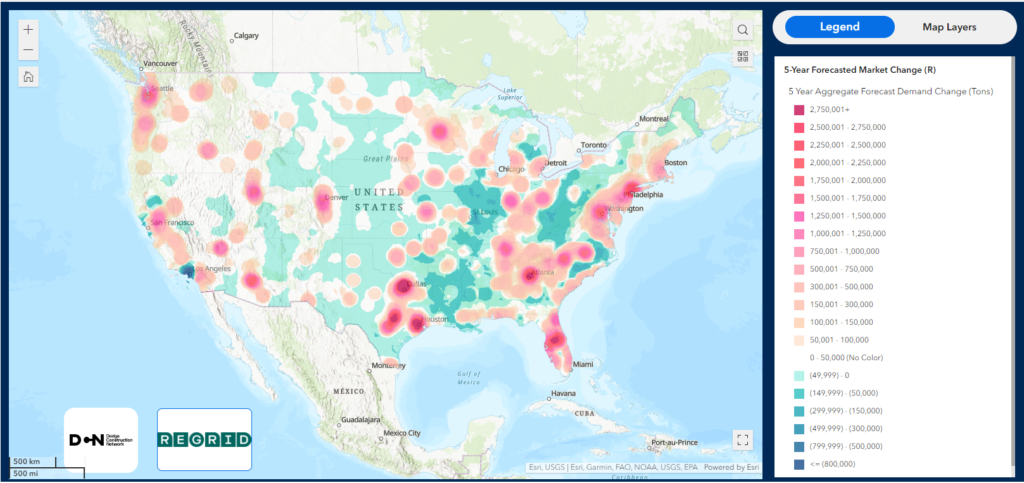

Just how are you supposed to get in front of all these companies to sell your product? What product do you even start with? If you’re selling logistics services, the small mom-and-pop operations are probably not your ideal clientele.

The Problem Isn’t Just for Newcomers

It’s not just the new guys who struggle with this. Even industry veterans know the pain of “driving for dollars”—spending days hunting for a quarry that closed three years ago or trying to navigate a phone tree just to get past the gatekeeper at the weigh scale.

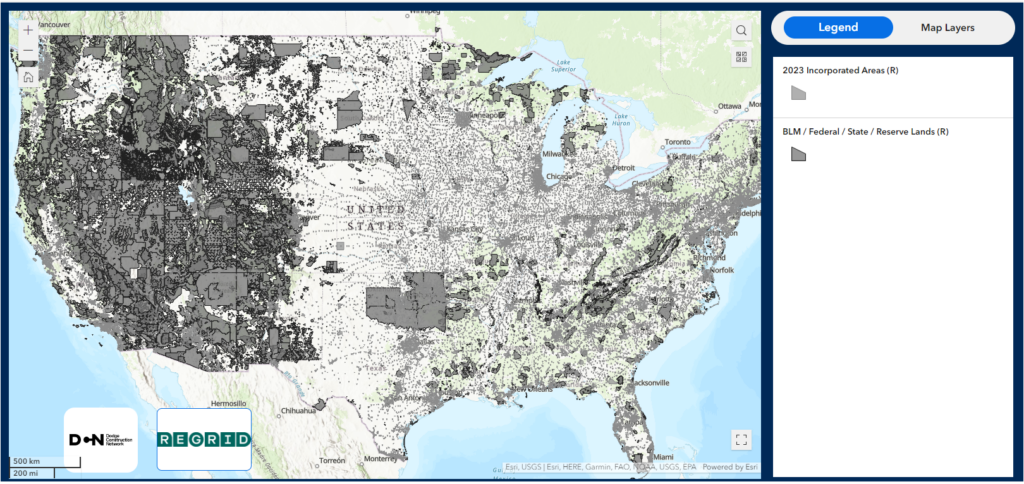

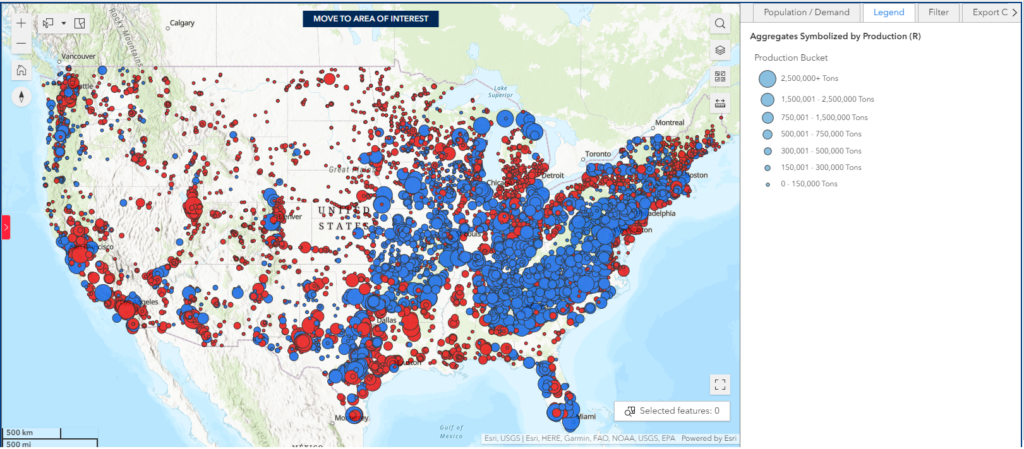

What if you had all of the active operators in the US at your fingertips? What if you could sort by commodity or production estimates, so you only had info on the companies that fit your specific business model?

Well, we have a surprise for you.

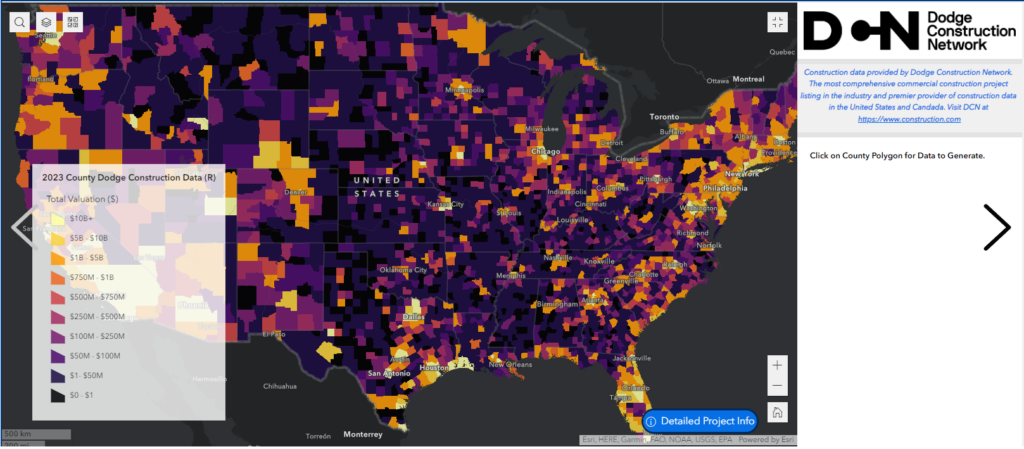

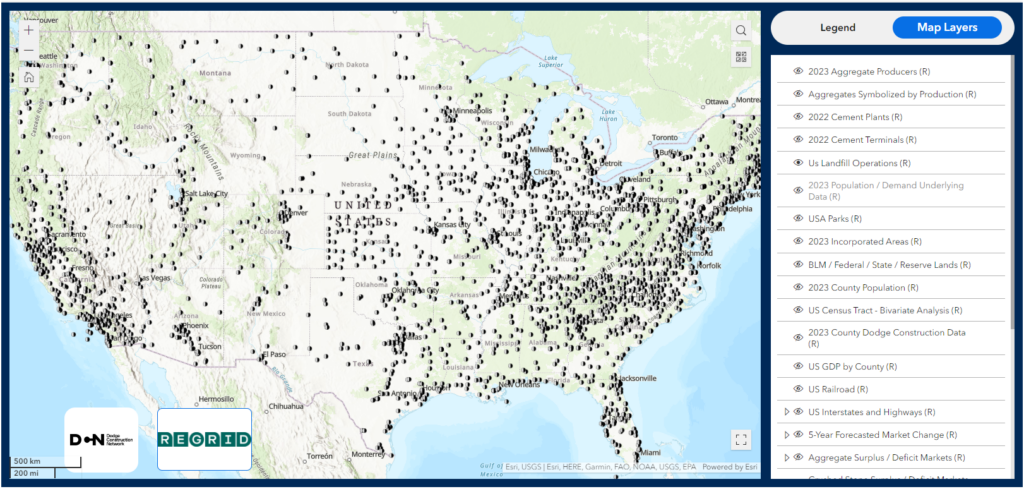

We have officially launched the REACH engine within the Mineralocity platform. Designed specifically for suppliers, REACH allows you to filter the entire U.S. market by location, commodity, and production size instantly.

But we didn’t stop at just showing you where they are.

Introducing Verified Contact Information We are now rolling out verified decision-maker contact info directly on the platform. We are starting with Utah and rolling out to the rest of the USA by mid-year.

No more guessing. No more driving to dead ends.

- New to the industry? Build a qualified prospect list in minutes.

- Industry Veteran? Stop wasting time on bad data and focus on closing deals.

Mineralocity turns that “overwhelming” market into a searchable, actionable pipeline.

Don’t just see the market—REACH it.