Introduction

In the ever-evolving landscape of the construction aggregate industry, one constant remains: the need to predict supply and demand accurately. Businesses that can forecast effectively find themselves better positioned in their markets and more prepared for future challenges. In this article, we delve into the rudiments of supply and demand in construction aggregates and how you can forecast future needs. We also introduce a groundbreaking tool, Mineralocity Aggregates, that can transform the way you look at market data.

Basic Supply and Demand Dynamics

The principles of supply and demand are universal, and in the aggregate industry, these factors can be influenced by a myriad of variables. However, a fundamental way to gauge market demand is by looking at the population within a defined radius of your operation—generally, 40 to 60 miles—and multiplying it by the regional per-capita annual construction aggregate consumption number. According to the National Stone, Sand & Gravel Association (NSSGA), the average stands at about 7-10 tons per capita. This number can vary significantly from year to year, so it is important to use a long term average.

To establish the supply and demand balance, you take the estimated supply in a specific region and subtract the demand. The resulting number will indicate whether you are dealing with a surplus or a deficit.

Projecting Future Demand

Estimating future demand is not a shot in the dark but a calculated extrapolation based on available data. One crucial element is population growth. By utilizing figures from sources such as the U.S. Census Bureau, it’s possible to estimate demand for the next 5, 10, 15, or even 20 years.

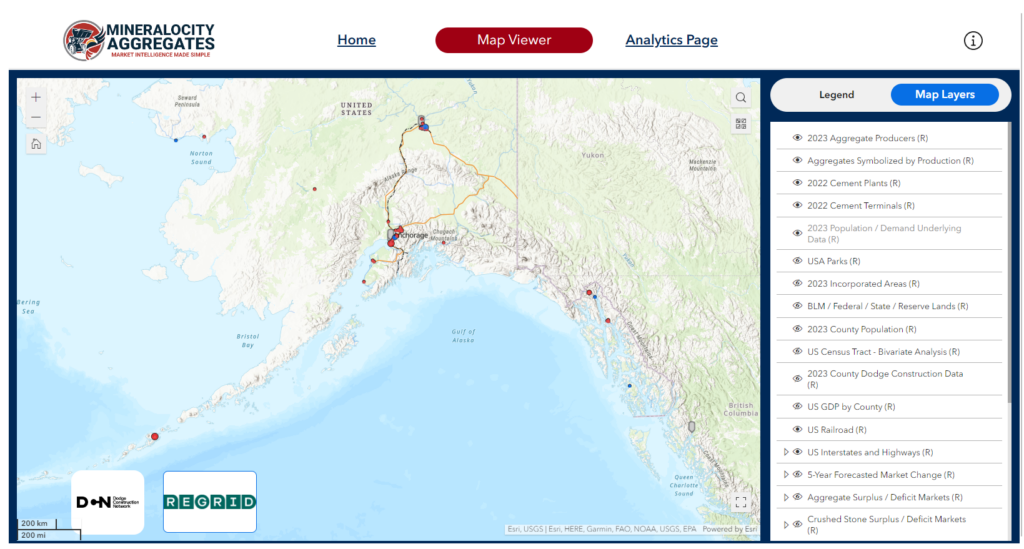

Mineralocity Aggregates: A Revolution in Forecasting

What if we told you that there’s a tool that has already calculated future demand for the entire United States, enabling you to compare current and future supply and demand side by side? Enter Mineralocity Aggregates.

With this platform, you can go a step further and quantify the value of future demand in each U.S. county. Leveraging proprietary data provided by Dodge Construction Network, we give you insights into planned but not yet started infrastructure projects that are likely to be aggregate-intensive.

Future-Proofing Your Business

Predicting and understanding market trends is crucial for the longevity of your business. Whether it’s monitoring the pulse of local demographics or keeping an eye on regional infrastructure projects, having the right data and tools at your disposal is a game-changer. Mineralocity Aggregates not only delivers this but also offers a user-friendly interface that makes the entire process efficient and effective.

Conclusion

Understanding the basic dynamics of supply and demand, combined with strategic forecasting, can make all the difference in positioning your aggregate business for long-term success. Mineralocity Aggregates simplifies this complex task, putting comprehensive data and predictive analytics at your fingertips.

Ready to get ahead of the curve? Request a free demonstration today to explore the depth and breadth of our platform’s capabilities.