In the highly competitive landscape of construction aggregates, it’s not just about acquiring assets—it’s about integrating the right assets. The quest for growth is no longer a mere numbers game. To ensure sustainable growth and success in today’s environment, it’s pivotal to target strategic aggregate acquisitions that align seamlessly with your company’s overarching goals and current structure. Here’s a deep dive into how you can make acquisition decisions that will future-proof your business.

1. Aligning with Organizational Goals:

Every business has its own vision and mission. Strategic aggregate acquisitions that don’t fit within these parameters might offer temporary boosts but can lead to long-term inefficiencies. Before making an acquisition decision, it’s crucial to evaluate if the target aggregate operation aligns with:

- Your company’s long-term strategy.

- Market segments you aim to serve.

- Technological and sustainability goals.

For instance, if your company aims to be a leader in sustainable construction, acquiring a quarry that already has a strong emphasis on green mining practices would be a strategic move.

2. Synergistic Potential:

Operational synergies can make or break the post-acquisition phase. Look for strategic aggregate acquisition opportunities that can:

- Integrate seamlessly with your existing supply chain.

- Offer complementary product lines.

- Enhance your distribution capabilities.

Consider the geographical location of the target operation. An acquisition closer to your current base can simplify logistics, offer quick integration, and reduce transportation costs.

3. Cultural and Leadership Compatibility: The Underestimated Element in Strategic Aggregate Acquisitions

While often overlooked, cultural compatibility can be the silent engine driving successful integration. Organizations with similar work cultures, values, and management styles are more likely to integrate smoothly. It ensures that employees from both sides feel valued, reducing post-acquisition attrition and fostering a unified, productive work environment.

4. Technology & Innovation

In an era where digital transformation is revolutionizing industries, including construction aggregates, it’s essential to assess the technological standing of your acquisition target. An operation that’s technologically advanced—or at least open to adopting new technologies—can offer you a competitive edge and streamline integration with your existing tech stack.

5. Assessing Financial Health:

While strategic fit is crucial, the financial health of a potential acquisition cannot be ignored. Comprehensive due diligence in understanding the target’s financial stability, debts, and liabilities ensures you’re not inheriting hidden financial burdens.

6. Potential for Growth: Expanding Horizons

When analyzing potential acquisitions, it’s easy to get caught up in the present – evaluating current assets, workforce, and output. However, the true value of an acquisition often lies in its potential for future growth. Here are key aspects to consider:

- Unexplored Markets: A strategic aggregate acquisition target might have strong ties in its current market, but what about neighboring regions or sectors? Assess if there’s potential to leverage the operation’s reputation and expand into new geographical or sectoral markets. For instance, a quarry that has been primarily serving local infrastructure projects might have the potential to supply to larger urban development projects in nearby cities.

- Untapped Customer Segments: Every operation has its set of loyal customers. But is there a clientele they haven’t yet reached? This could be due to lack of marketing strategies, distribution channels, or simply product offerings. Acquiring an operation with an already strong reputation gives you a head start to tap into these untouched segments.

- Introduction of New Product Lines: Assess the operation’s potential to diversify its product range. For instance, if the quarry primarily produces a specific type of aggregate, could it potentially explore other varieties? Maybe there’s an opportunity to introduce value-added products, further processing the aggregates, or venturing into related products like ready-mix concrete.

- Infrastructure and Expansion: Does the target strategic aggregate acquisition have the necessary land and permissions for expansion? Future growth isn’t just about market reach but also about capacity. A site that has ample space for expansion, or one that has already secured permits for further development, can be an invaluable asset for companies aiming for long-term growth.

- Innovation and R&D: What is the strategic aggregate acquisition target’s stance on research and development? In the aggregates industry, continuous innovation can lead to the discovery of more efficient extraction methods, better product quality, and sustainable practices. An operation that already invests in or is open to R&D can be a goldmine for forward-thinking businesses.

By ensuring that a potential acquisition has avenues for growth, you’re not just securing assets for your business’s present but also fortifying its future. It’s about vision, foresight, and the ability to see beyond the immediate horizon. Need help assessing the financial health, operational strengths, or market position of a strategic aggregate acquisition? Consider hiring an expert, like Burgex Mining Consultants, to help.

Conclusion:

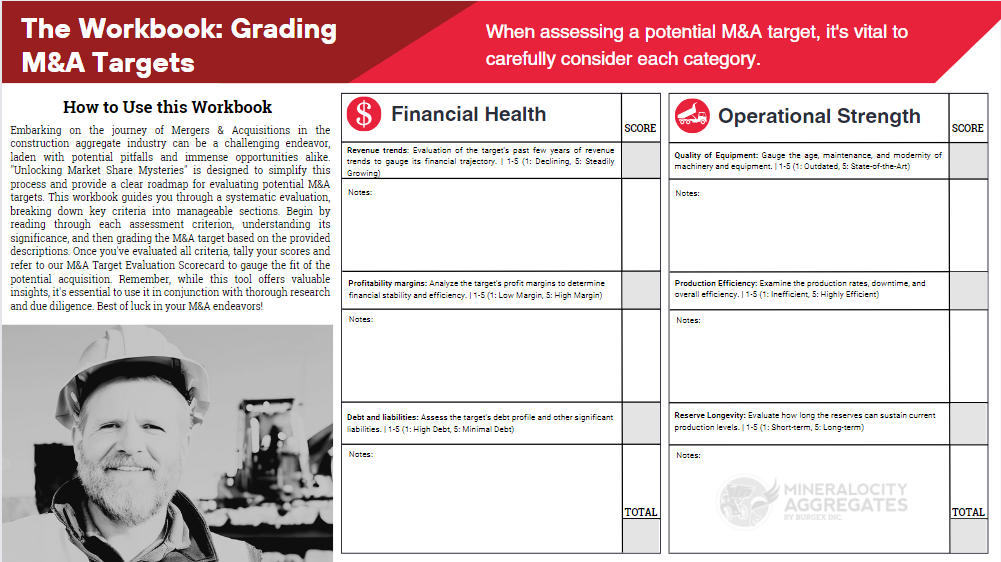

In the dynamic world of construction aggregates, M&A decisions need to be more strategic than ever. It’s not just about adding assets; it’s about adding value. As you seek to expand and grow, focus on acquiring strategic aggregate operations that not only complement your existing business but also align with your vision for the future. After all, the ultimate aim is not just to grow bigger, but to grow smarter. Dive deep into your acquisition strategies with tools like the M&A workbook from Mineralocity Aggregates to ensure you’re always making the right moves. Your business’s future depends on it.

Are You Prepared to Master the Art of Aggregate M&A Target Evaluation?

Unlock the secrets of successful M&A in the aggregates industry with our comprehensive workbook. Packed with actionable insights, best practices, and strategic tools, this guide is your blueprint for making informed, profitable decisions.

Don’t miss your chance to elevate your M&A game—download now!