We’re excited to announce a major renovation of the Mineralocity platform, based directly on your feedback. We are adding powerful new data, more intuitive features, and new ways for your team to collaborate.

Contact Us Today

Contact Us Today

We’re excited to announce a major renovation of the Mineralocity platform, based directly on your feedback. We are adding powerful new data, more intuitive features, and new ways for your team to collaborate.

Since the very beginning, Burgex has helped shape AggNexus with one goal in mind: creating meaningful, impactful conversations in the aggregates and concrete space.

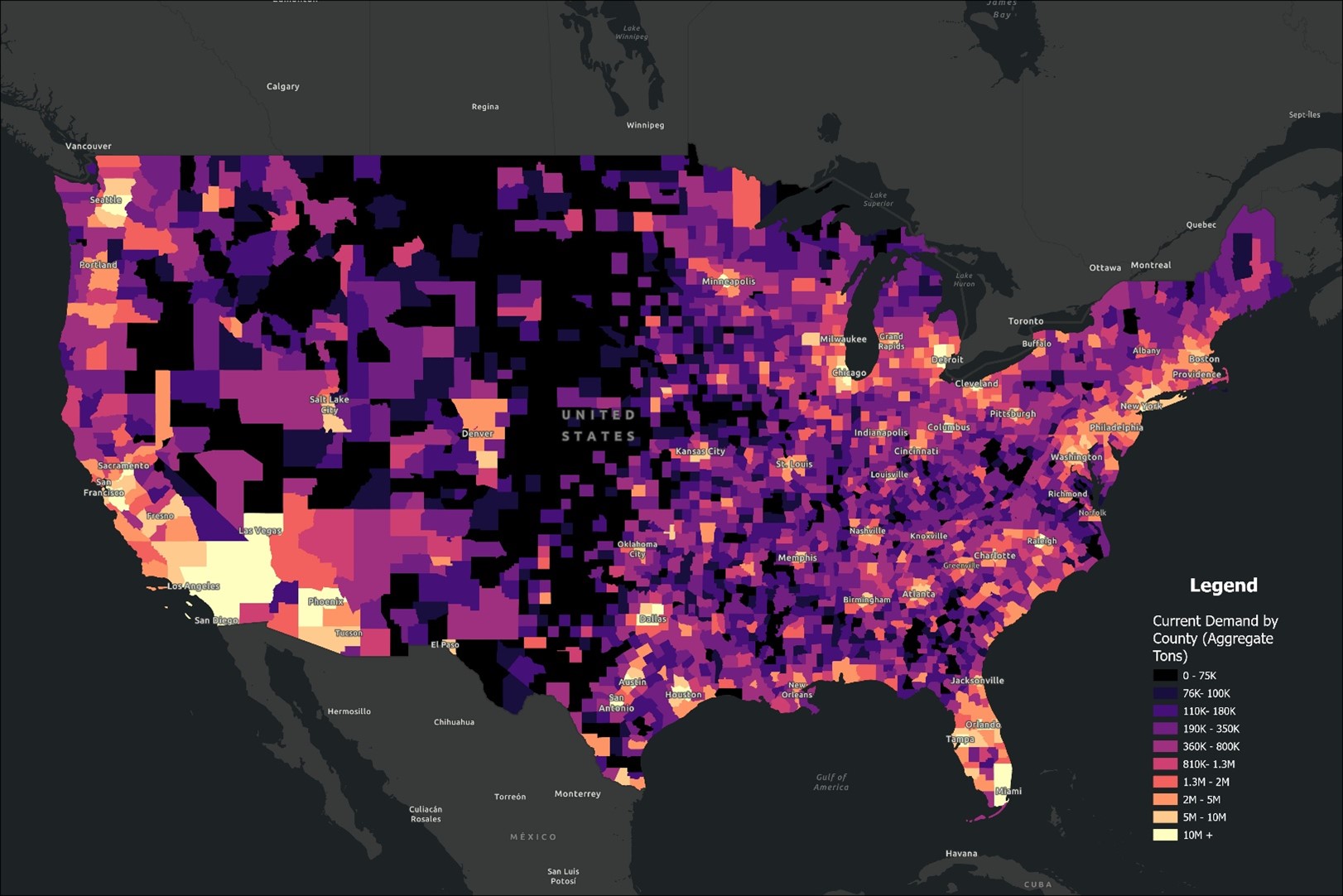

Explore the top 25 U.S. counties by estimated aggregate demand in 2024. Learn how construction trends, infrastructure investments, and population growth are driving demand for aggregates across key regions.

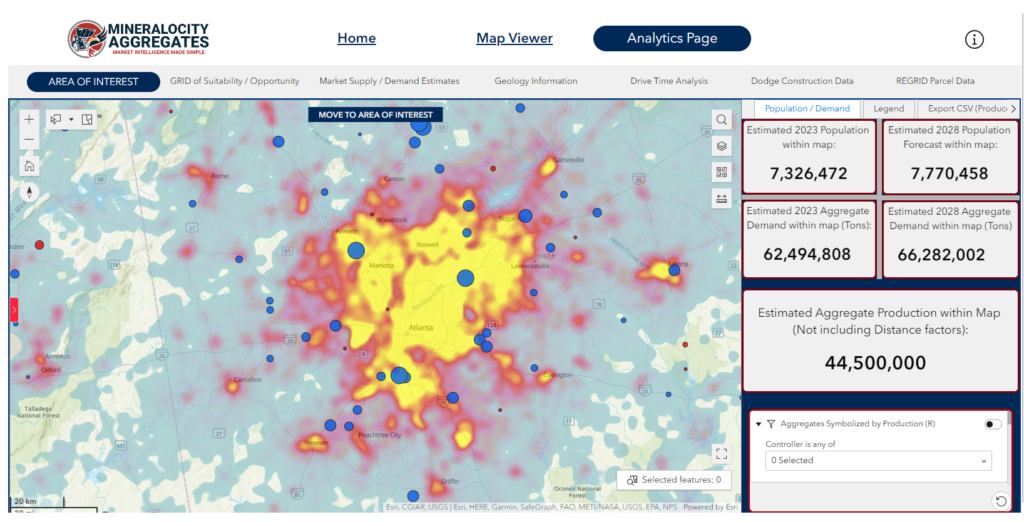

As we continue to develop and refine the Mineralocity platform, we’re excited to share the powerful capabilities it offers for both greenfield exploration and high-level market research. Whether you’re looking to gain insight into a new area for mineral discovery or analyze broader market trends, Mineralocity is the tool to help you make data-driven decisions with ease.

As we move forward into another successful quarter, we want to take a moment to reflect on the value we’re committed to providing. At Burgex, we see our relationship with you as more than just service—it’s about sharing knowledge, insights, and resources that empower your success.

The aggregate industry is rapidly evolving, with mergers and acquisitions (M&As) at the forefront of its transformation. While the financial benefits of these moves are often spotlighted, the potential for creating operational efficiencies — or “Aggregate Merger Synergies” — is equally significant, especially when acquisitions occur within the same region.

Harnessing Aggregate Merger Synergies, especially within the same region, offers a golden opportunity to capitalize on enhanced distribution nodes. This essentially means multiple distribution points, strategically located, that can serve a wider area efficiently. But what exactly does this entail?

Centralized Inventory Management: With multiple nodes, inventory can be managed centrally. This ensures that any supply shortages in one node can be quickly addressed by redistributing from another nearby node, guaranteeing consistent supply to all clients.

Reduced Delivery Times: Proximity to key markets means reduced transportation distances. The result is faster delivery times, which not only delights customers but also means lower transportation costs, translating to better margins.

Adaptive Distribution Strategies: With multiple nodes at their disposal, aggregate companies can swiftly adapt to changing market conditions. For instance, if there’s an unexpected construction boom in a particular area, nearby nodes can prioritize supplies to that region.

Economies of Scale: As the number of distribution nodes increases, aggregate companies can benefit from economies of scale in terms of procurement, storage, and distribution. Bulk purchases, for instance, become more feasible and cost-effective.

Increased Market Penetration: With more distribution nodes, companies can penetrate deeper into existing markets, reaching even the more remote clients. This enhanced reach can significantly boost sales and revenue.

By acquiring operations close to existing assets, companies can immediately leverage these benefits of enhanced distribution nodes. The proximity ensures materials can be transported to customers more efficiently, fostering increased loyalty and bolstering customer satisfaction.

“Aggregate Merger Synergies” not only speaks to the strategy of combining operations but also to the tangible benefits gained from sharing vital infrastructure and maintenance resources. When operations in the same region combine forces, they can leverage shared assets for maximum efficiency. Let’s explore how:

Unified Equipment Management: Instead of each site having separate equipment with potential downtimes, merging allows for the pooling of machinery. This leads to better equipment utilization rates and decreased periods where costly equipment is lying idle.

Centralized Repair Centers: Instead of scattered repair and maintenance facilities, a centralized hub can serve multiple operations. This allows for specialized technicians, bulk purchase of spare parts, and quicker response times, ensuring minimal disruption to operations.

Optimized Logistics: Shared transportation and storage facilities mean that logistics become a more streamlined affair. Trucks and conveyors can serve multiple sites, reducing the need for redundant assets.

Shared Expertise: Maintenance isn’t just about machinery. It’s about the people who operate and care for that machinery. By combining forces, teams can share expertise and best practices, leading to more consistent and efficient maintenance routines.

Bulk Purchasing Power: When multiple operations come together, their collective purchasing power increases. Whether it’s buying machinery, spare parts, or maintenance services, bulk purchases often translate to cost savings.

In essence, the synergy arising from shared infrastructure and maintenance can lead to significant cost reductions. Moreover, with streamlined processes and a collective approach, the operational efficiency of the merged entities can see a marked improvement, reinforcing the value proposition of the merger.

Within the domain of “Aggregate Merger Synergies,” the consolidation of managerial roles and responsibilities can be a game-changer. As operations within the same region merge, there’s a golden opportunity to optimize and harmonize the managerial landscape. Here’s why shared management stands out:

Unified Vision and Strategy: With a shared management team, there’s a single vision guiding the merged entities. This unified direction ensures that all sites work cohesively towards a common goal, eliminating potential conflicts and disjointed strategies that can arise with separate management.

Reduced Overhead Costs: By eliminating redundant managerial positions, companies can realize significant cost savings. Instead of multiple managers overseeing similar roles across different sites, a streamlined managerial team can efficiently handle combined operations.

Faster Decision-Making: A consolidated management structure tends to result in quicker decisions. With fewer hierarchical layers and a centralized leadership, responses to market changes or operational challenges become more agile.

Knowledge Sharing and Best Practices: Shared management fosters an environment where knowledge transfer becomes the norm. Managers from different sites can share insights, experiences, and best practices, enhancing the operational efficiency of the entire merged entity.

Enhanced Stakeholder Communication: With a unified management team, communication to stakeholders—whether they’re investors, employees, or partners—becomes more consistent and transparent. This clarity can bolster stakeholder confidence and trust in the merged organization’s direction and decisions.

Incorporating shared management within the fabric of “Aggregate Merger Synergies” not only provides immediate cost and operational benefits but also sets the foundation for long-term growth and sustainability of the combined entities.

When considering “Aggregate Merger Synergies”, understanding and integrating local market intelligence becomes paramount. As operations within a specific region consolidate, companies gain the invaluable advantage of pooled local knowledge. Here’s why this collective wisdom stands out:

In-depth Customer Insights: By merging with an operation already embedded in the local market, companies can instantly access a treasure trove of customer preferences, habits, and feedback. This data enables tailored marketing strategies, product tweaks, and enhanced customer service approaches.

Navigating Regulatory Challenges: Local markets often come with unique regulatory landscapes. Acquiring a company with years of on-ground experience means benefiting from their established relationships with local authorities and their understanding of navigating local regulations efficiently.

Identifying New Opportunities: A combined local perspective provides a more holistic view of untapped market segments, emerging trends, or underserved customer needs. Leveraging this knowledge can lead to innovative products or services that address these gaps.

Risk Mitigation: Local knowledge often extends to understanding market risks, whether they’re geopolitical, economic, or environmental. By pooling insights from multiple local teams, companies can devise more robust risk assessment and mitigation strategies.

Cultural Synergies: Beyond just operational and market insights, understanding the local culture, values, and norms is essential. It aids in ensuring that branding, communication, and community engagement are resonant and authentic.

In the realm of “Aggregate Merger Synergies”, the blending of local market knowledge is akin to piecing together a puzzle. Each piece, representing insights from different operations, culminates in a comprehensive and actionable picture of the local market.

The essence of “Aggregate Merger Synergies” isn’t just about combining forces, but about judiciously deploying resources to capitalize on those combined strengths. Efficiently allocating resources post-merger can be transformative, with several key benefits:

Optimized Equipment Utilization: Instead of each operation owning and maintaining separate sets of equipment, mergers can lead to a centralized pool. This allows for the flexible deployment of machinery based on demand peaks, thereby minimizing idle time and maximizing utilization rates.

Centralized Procurement: By consolidating procurement processes, companies can leverage their increased purchasing power to negotiate better terms with suppliers. This can lead to significant cost savings and improved supply chain reliability.

Redistribution of Workforce: With a broader operational landscape, employees can be strategically positioned where they are needed most. This can help in addressing workforce shortages in one location by reallocating personnel from another.

Streamlined Inventory Management: Holding inventory ties up capital and can be costly. By assessing the combined inventory needs and turnover rates, companies can reduce redundant stock, maintain optimal inventory levels, and decrease warehousing costs.

R&D Synergies: Research and development, especially in product innovation and process improvements, can be centralized. This prevents duplicate efforts, streamlines innovation pipelines, and allows for faster rollout of advancements across merged operations.

Through “Aggregate Merger Synergies”, the objective isn’t merely about adding resources but deploying them in a manner that extracts the maximum value for both operations and customers. This strategic distribution and management of resources can lead to significant operational efficiencies, cost savings, and competitive advantages.

Operational synergies provide the foundation for successful mergers and acquisitions in the aggregates industry. By fostering enhanced distribution, shared infrastructure, consolidated management, localized market intelligence, and efficient resource deployment, companies can propel their combined entities towards unparalleled success.

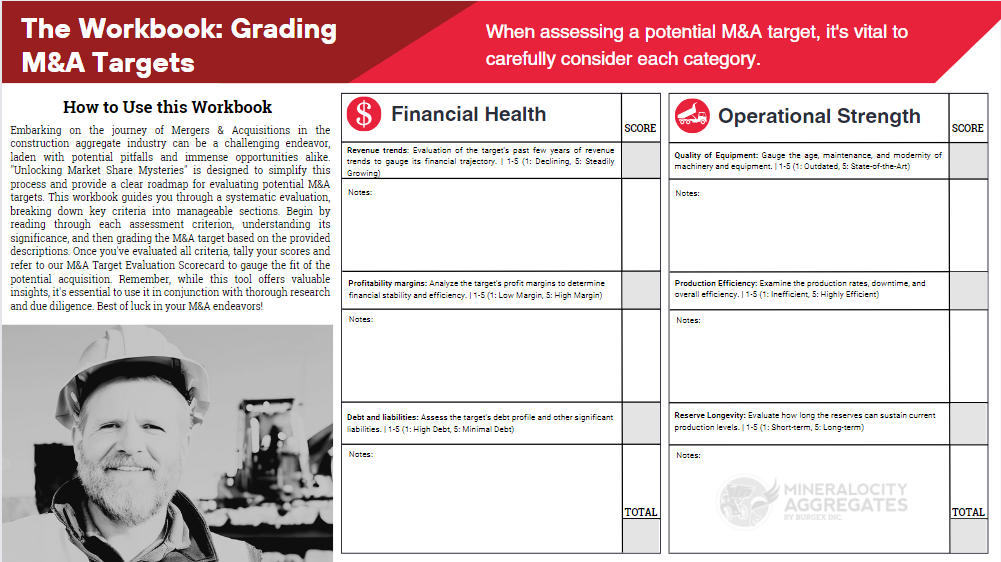

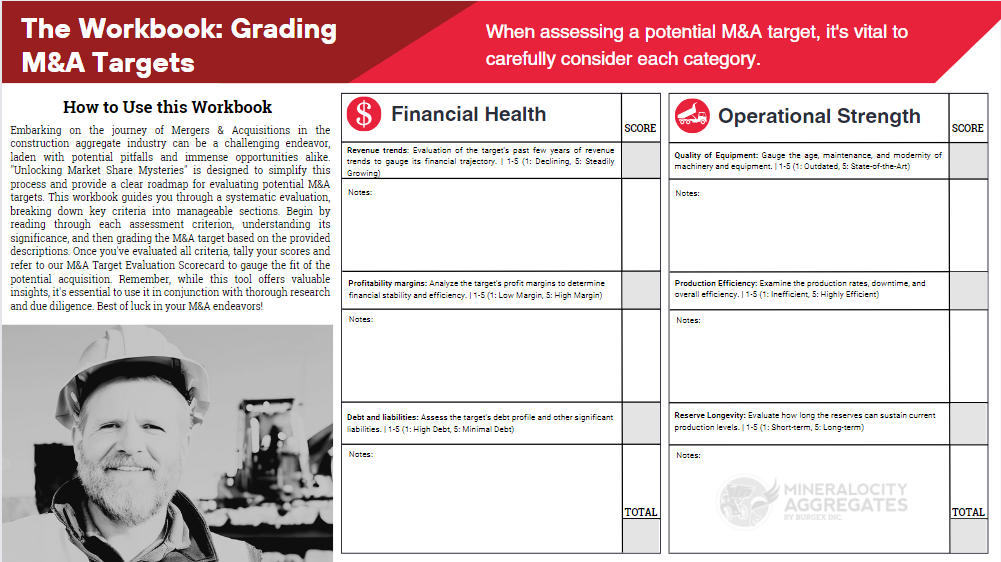

However, creating these synergies and maximizing their benefits requires a clear roadmap. That’s where our comprehensive M&A guide and workbook come into play. Designed to walk you through every facet of the M&A process, this resource is an invaluable tool for any company looking to explore the advantages of aggregate mergers.

Moreover, in an industry as dynamic as construction aggregates, you need a partner that understands the intricacies of the trade. Mineralocity Aggregates is not just a platform; it’s your trusted ally. From in-depth data insights to unparalleled market analysis capabilities, we ensure that you’re equipped with the best tools and knowledge as you embark on your M&A journey.

Unlock the full potential of aggregate merger synergies. Dive deep into our M&A guide, leverage the power of Mineralocity Aggregates, and pave the way for a brighter, more efficient future in the aggregates industry.

Unlock the secrets of successful M&A in the aggregates industry with our comprehensive workbook. Packed with actionable insights, best practices, and strategic tools, this guide is your blueprint for making informed, profitable decisions.

Don’t miss your chance to elevate your M&A game—download now!

The quest for the ideal location for construction aggregate production goes beyond a simple glance at the surface. Geological considerations form the bedrock (pun intended) of any decision to establish a greenfield site for aggregate production. While the presence of the desired resource is a crucial factor, numerous other geological considerations play an equally vital role. Here’s a comprehensive look at both the obvious and the subtle geological factors you should weigh before committing to a site.

The mere presence of the desired mineral resource is just the beginning. To understand the true potential of a site, a robust drilling and testing program is essential. This involves core, rotary, or sonic drilling to retrieve samples from various depths, allowing you to analyze the type, quality, and volume of the aggregate. Producing detailed logs from these drills provides insights into the vertical and horizontal spread of the resource. Moreover, rigorous testing of these samples can determine quality and consistency, ensuring that the construction aggregate meets specific standards. Only with this detailed data can one calculate a potential resource, giving a clear picture of the site’s profitability and lifespan.

Overburden—the layer of soil and rock overlying a mineral deposit—can sometimes be excessive and may prove uneconomical to remove and store. Proper geological surveys can provide estimates of the volume of overburden and allow for efficient planning of its removal and disposal.

The size of the site should not only accommodate the extraction of the desired aggregate volume but should also factor in requirements such as sloping, benches, and buffer zones to ensure stability and compliance with safety standards.

A crucial yet often overlooked factor is the depth and behavior of the water table. Mining operations can hit a snag if they inadvertently puncture the water table, leading to flooding. Additionally, dewatering solutions might be required, which can be costly and have potential environmental implications.

Understanding the structural geology of a site is essential. Hidden faults or underground anomalies might jeopardize the safety of the operations. Utilizing geophysical methods like seismic surveys or ground-penetrating radar can provide invaluable insights into what lies beneath.

Safety is paramount. Sites with a history of landslides, subsidence, or other geotechnical risks require thorough assessment. The angle of repose, the steepest angle at which a sloping surface is stable, should be identified for different materials to avoid accidental collapses.

The chemical composition of the aggregate can sometimes present unexpected challenges. Some minerals might react adversely with specific chemicals, while others might degrade rapidly when exposed to environmental conditions. A comprehensive mineralogical study can prevent such unwelcome surprises.

External geological factors, like proximity to volcanic zones or floodplains, could pose operational risks. Such risks might not directly concern the site’s immediate geology but can profoundly impact the longevity and safety of the mining operation.

Beyond geological considerations, understanding the market dynamics and logistical aspects is vital. This is where tools like Mineralocity Aggregates come into play, providing insights into demand, potential markets, and the best transportation routes.

Embarking on the establishment of a greenfield site for aggregate production without comprehensive geological considerations is akin to navigating uncharted waters without a map. From understanding the very anatomy of the site to recognizing external geological threats, an in-depth evaluation paves the way for a successful and safe operation. Armed with these insights and the right tools like Mineralocity Aggregates, you’re poised to make informed decisions that maximize profitability while ensuring safety and sustainability.

Dive deeper into the world of construction aggregate production with our exclusive Greenfield Guide. Whether you’re a seasoned expert or just embarking on your aggregate adventure, this guide is your roadmap to identifying prime locations, assessing supply potential, and capturing significant market shares. Arm yourself with proven strategies, actionable insights, and essential formulas designed to propel your projects to unparalleled success. Don’t miss this chance to elevate your greenfield endeavors – grab your free copy of the Greenfield Guide now!

When seeking to start a new aggregate operation, one of the first questions a potential operator will ask is, “How much land do I need?” It’s an essential query that determines the scale, longevity, and feasibility of the project. While the specifics of land requirements can vary based on numerous factors, understanding some benchmarks is a good starting point.

The type of aggregate you’re planning to produce plays a significant role in determining the land requirements:

Crushed stone quarries, as mentioned, often come with the challenge of more overburden. This loose, often unconsolidated material covering the aggregate can be a mixture of soil, clays, and smaller rock fragments. The presence of overburden isn’t merely an operational challenge; it’s also a spatial one. Overburden can’t be stacked indefinitely high due to its nature; it’ll naturally slope or spread out, consuming valuable land space.

While the numbers above provide a raw estimation of land size for actual extraction, several other components come into play:

Though it’s tempting to think in terms of just acreage, the real challenge and opportunity lie in planning. With careful mine planning, even a relatively smaller land area can turn into a highly productive and efficient aggregate site. Consider the entire lifecycle of the mine, from start to reclamation, and ensure the space can accommodate all stages. Additionally, leveraging modern technology, like Mineralocity Aggregates’ suite of tools, can aid in finding and creating an efficient and profitable operation.

The adage “more is better” holds some truth in the world of aggregate operations. While more land offers flexibility, scalability, and potentially a longer operational life, it’s also about what you do with the land you have. With the right planning, technology, and understanding of the requirements and challenges, both sand and gravel pits and crushed stone quarries can be designed to maximize efficiency, minimize environmental impacts, and deliver substantial profits, regardless of size.

Efficiency in site selection is often an amalgamation of thorough research, precise planning, and the right technological assistance. Mineralocity Aggregates excels in aiding this selection process with its comprehensive suite of tools. From its 30 basemap layers and detailed geology layers to the invaluable Regrid Nationwide Land Parcel data, Mineralocity offers capabilities that are tailor-made for the aggregate industry. Particularly noteworthy is the ability to filter land parcels to target sites that align with your specific acreage requirements. This level of precision and detail ensures that you’re always a step ahead in your greenfield site ventures.

Remember, the initial phase of assessing a potential greenfield aggregate site is just the beginning. As you delve deeper into the nuances of the site, leveraging specialized tools and expertise becomes not just advantageous but essential. In this regard, Mineralocity Aggregates stands as an invaluable partner, ensuring that your investment and efforts consistently bear fruit.

Dive deeper into the world of construction aggregate production with our exclusive Greenfield Guide. Whether you’re a seasoned expert or just embarking on your aggregate adventure, this guide is your roadmap to identifying prime locations, assessing supply potential, and capturing significant market shares. Arm yourself with proven strategies, actionable insights, and essential formulas designed to propel your projects to unparalleled success. Don’t miss this chance to elevate your greenfield endeavors – grab your free copy of the Greenfield Guide now!

In the dynamic world of the aggregate industry, opportunities for growth and expansion often present themselves in the form of Mergers and Acquisitions (M&A). These strategic moves can be game-changers, propelling businesses to new heights of productivity, market share, and profitability. However, the road to a successful M&A is paved with diligent research, detailed analysis, and strategic decision-making.

Before embarking on an M&A journey, it is crucial to understand the full value of the opportunity that lies ahead. Much like an iceberg, what’s visible on the surface often only represents a fraction of the total picture. The real essence lies beneath the surface – in the company’s operations, customer base, market position, and potential for growth.

This article will serve as your compass in navigating the M&A landscape. It focuses on uncovering the hidden potential and optimization opportunities of an M&A target. Whether you’re a seasoned industry player or a newcomer looking to make a mark, this guide will provide invaluable insights into finding market upside in an M&A opportunity.

By using the tips and strategies outlined in this guide, you’ll be able to assess the true potential of your target, understand its value beyond financials, and position yourself for a successful integration and growth.

In the forthcoming sections, we’ll dive deeper into understanding the value of an M&A opportunity, identifying growth and expansion opportunities, maximizing value from the acquisition, and leveraging advanced tools like Mineralocity Aggregates for efficient market analysis.

So, buckle up and prepare for an enlightening journey towards finding your next big M&A opportunity!

Just as every person has a unique story, so does every business. A company’s true value extends far beyond its balance sheet, encompassing an array of tangible and intangible assets that contribute to its overall market potential. Recognizing this intrinsic value is a critical starting point when identifying potential growth and expansion opportunities in an M&A deal.

Consider the following areas when assessing a target’s true value:

Every company has hidden assets and unique advantages that, if capitalized upon, could fuel post-acquisition growth. Dig deep into each aspect of the target’s business, unearthing hidden gems of potential that could be polished to perfection with the right strategies.

In the next section, we’ll delve deeper into how to identify growth and expansion opportunities in your M&A target, transforming your acquisition into a catalyst for business growth.

After evaluating the true value of your M&A target, the next step is to identify areas of growth and expansion that can be realized post-acquisition. This requires a strategic, forward-thinking mindset, as you’ll need to envision the company’s future performance under your management and direction.

Here are several strategies to help you find that hidden potential:

Finding the hidden potential in an M&A opportunity is like mining for gold. It requires patience, dedication, and strategic foresight. But with the right tools and approach, you can uncover opportunities that catapult your new acquisition into a market-leading position.

In the next section, we will explore how Mineralocity Aggregates can assist you in finding these hidden growth opportunities, ensuring your M&A strategy delivers a bedrock of success.

Now that you have identified the areas of growth and expansion in your prospective acquisition, the next crucial step is to efficiently capitalize on these opportunities. This is where Mineralocity Aggregates can play an instrumental role.

Here’s how our platform can support your M&A strategy:

As you can see, Mineralocity Aggregates is more than just a technology platform; it’s your partner in growth and success. By leveraging the capabilities of our platform, you can realize the full potential of your M&A opportunity, ensuring that your new venture not only thrives but leads the market.

In our final section, let’s explore how to implement these strategies for successful integration post-acquisition.

Successful post-acquisition integration is arguably as vital as the due diligence phase. It’s during this stage where the real work begins to derive value from your new venture. The following steps are crucial in this process:

Establishing Clear Goals: With your identified opportunities from the acquisition, it’s essential to set clear, actionable goals. Whether it’s expanding into a new market, increasing production capacity, or integrating new technologies, having precise objectives will provide a roadmap for your post-acquisition strategy.

Creating an Integration Plan: A detailed integration plan is the blueprint for achieving your goals. This plan should include tasks, timelines, responsible parties, and metrics for success. It’s also crucial to factor in potential risks and mitigation strategies.

Leveraging Mineralocity Aggregates: Our platform can be integral to your integration plan. From facilitating strategic decision-making with comprehensive market data to driving operational efficiencies with our advanced tools, Mineralocity Aggregates can be an invaluable partner in your post-acquisition journey.

Communication and Training: Keep your team informed about the changes and provide them with the necessary training. This not only helps in smooth integration but also ensures that your workforce is equipped to utilize the full potential of Mineralocity Aggregates.

Monitoring and Adjusting: Post-acquisition integration is not a set-and-forget process. Regular monitoring of your progress against set goals is necessary. Equally important is being flexible and ready to adjust your strategy based on the evolving business environment and performance metrics.

The journey of finding market upside in an M&A opportunity may seem complex, but it doesn’t have to be. With careful planning, a strategic approach, and the right tools like Mineralocity Aggregates at your disposal, you can unlock the full potential of your new venture.

Remember, an M&A is not just a transaction; it’s the beginning of a new chapter in your growth story. Make it a successful one.

In conclusion, uncovering the market upside in an M&A opportunity is both an art and a science. It requires a blend of strategic foresight, thorough due diligence, and meticulous post-acquisition integration. While the process may appear daunting, the rewards can be significant, offering unprecedented growth, increased market share, and operational efficiencies.

It’s also important to remember that you’re not alone in this journey. At Mineralocity Aggregates, we’re committed to providing the tools and insights you need to make informed, strategic decisions. Our platform offers data-driven solutions that can simplify your due diligence process, highlight potential growth areas, and even facilitate smoother post-acquisition integration.

As you move forward in your M&A journey, remember this: every acquisition has its challenges, but with careful planning, the right resources, and a clear vision of what you hope to achieve, you’re well on your way to finding the hidden market upside and creating a success story of your own.

Unlock the secrets of successful M&A in the aggregates industry with our comprehensive workbook. Packed with actionable insights, best practices, and strategic tools, this guide is your blueprint for making informed, profitable decisions.

Don’t miss your chance to elevate your M&A game—download now!

Crushed stone, sand, gravel, and other construction aggregates account for half of the industrial minerals produced in the United States.

These materials represent a $29 billion per year business in the country.

The map above from our sponsor Burgex uses data from Mineralocity to show where aggregates are produced in America.

Aggregates are a variety of materials produced in pits or quarries, including sands, gravel, and crushed stone.

They are usually used in construction, with the largest proportion used to manufacture concrete.

On average, each person in America drives demand for over 10,000 lbs of stone and around 7,000 lbs of sand and gravel per year.

Ten states produce more than 50% of the country’s construction aggregates.

The five leading States are, in descending order of total output: Texas, California, Florida, Ohio, and Pennsylvania.

| State | Crushed Stone Sold in 2021 (Thousand metric tons) | Construction Sand and Gravel Sold in 2021 (Thousand metric tons) |

|---|---|---|

| Texas | 170,000 | 95,200 |

| California | 51,000 | 114,000 |

| Florida | 94,900 | 21,700 |

| Ohio | 69,900 | 35,200 |

| Pennsylvania | 87,700 | 6,830 |

Over 7,000 U.S. commercial aggregate companies are currently operating.

Growing urban areas across the U.S. and the rise in high-rise structures, which use concrete extensively, are expected to continue boosting demand for aggregates.

Additionally, maintenance of aging infrastructure across the country is expected to support the demand. In 2011, a study by the United States Geological Survey concluded that one-third of America’s major roads were in poor or mediocre condition, and over one-quarter of the bridges were either structurally deficient or functionally obsolete.

In this scenario, the aggregates market in the U.S. is expected to grow by 263.53 million tons from 2021 to 2026, at an annual average growth rate of over 2.5%.

This article was published by Visual Capitalist on March 14, 2023

Article/Editing: Bruno Venditti

Graphic Design: Miranda Smith

Dive deeper into the world of construction aggregate production with our exclusive Greenfield Guide. Whether you’re a seasoned expert or just embarking on your aggregate adventure, this guide is your roadmap to identifying prime locations, assessing supply potential, and capturing significant market shares. Arm yourself with proven strategies, actionable insights, and essential formulas designed to propel your projects to unparalleled success. Don’t miss this chance to elevate your greenfield endeavors – grab your free copy of the Greenfield Guide now!