In our last exploration into identifying M&A opportunities in aggregates, we delved deep into the various considerations one must account for when assessing an M&A opportunity within the aggregates industry. Today, we pivot to the intriguing world of market dynamics. Let’s uncover those hidden gems that, with the right strategy, can transform a moderate operation into an industry titan.

1. Rail Access and Identifying M&A Opportunities in Aggregates: Untapped Potential

The presence of an existing rail spur, especially one that’s underutilized, is a significant asset when considering M&A opportunities in the aggregates industry. Rail transportation offers a cost-effective, efficient, and sustainable means of transporting large volumes of aggregates to distant markets, especially when road transportation may be congested or less efficient for bulk shipping. An existing rail spur that’s not being fully utilized represents an immediate opportunity for expansion.

But beyond the sheer logistics, there’s an aspect of environmental consciousness. Rail transportation, being more carbon-efficient than trucking, can be a selling point to environmentally conscious stakeholders, including the surrounding communities and potential clients who prioritize green initiatives.

However, it’s not just about the present infrastructure—it’s also about potential. A quarry’s proximity to a rail line, combined with adequate acreage, opens the door to future developments that could further bolster transportation capabilities. Imagining and planning for a future rail spur can be a significant move when strategically identifying M&A opportunities in aggregates. Such locations offer the possibility of building a new rail spur, aligning with rail companies, and exploring lucrative contracts. This foresight can lead to a transformative shift in a company’s operational strategy, tapping into markets that were previously uneconomical due to transport constraints.

In both scenarios, whether leveraging an existing rail spur or recognizing the potential to build one, the strategic advantage is evident. Such assets, when coupled with nearby rail markets, can dramatically reduce transportation costs, increase market reach, and provide a competitive edge in the rapidly evolving aggregates industry.

2. Merging Generations: The Strength in Family-owned Quarries

Family-owned quarries, deeply rooted and often operated over several generations, carry a rich history and a wealth of tacit knowledge. These establishments become emblematic of the community’s identity, with relationships and goodwill built over time. Individually, they might face challenges in market expansion, capital investment, or operational efficiency. But here’s where the potential for identifying M&A opportunities in aggregates becomes evident.

When several such family-run entities are combined, the resulting entity can exploit operational synergies and benefit from cumulative expertise. The pooling of resources, from machinery to experienced personnel, can lead to more robust operations, and the amalgamation of local market knowledge can enhance strategic planning and decision-making. By centralizing certain operations, optimizing supply chains, and merging administrative functions, the combined entity can realize cost savings that individual operations might never achieve.

Furthermore, in the modern era where branding and storytelling can significantly influence market position, there’s an unexplored narrative strength in family-owned establishments. A consolidated branding strategy could weave together the histories and values of each entity, crafting a compelling narrative that captures the ethos of hard work, tradition, and community. Such an approach could strengthen its market position, leveraging the trust and reputation that family-run businesses often enjoy in their local communities, and making it a compelling story when identifying M&A opportunities in aggregates.

3. Geo-strategic Acquisitions: Optimal Location Benefits for Identifying M&A Opportunities

In the aggregates industry, location can make or break an operation. The strategic importance of a quarry’s location, especially its proximity to high-demand areas, cannot be overstated. Quarries located near growing urban centers or key infrastructure projects can be literal goldmines. Their geographic positioning places them in a prime spot to cater to booming construction and infrastructure development needs.

Imagine the potential of a quarry sitting at the edge of a developing city or along the route of a proposed highway. Even if these sites are currently underutilized, inefficiently run, or faced with resource constraints, their very position offers lucrative potential. Acquiring such quarries means immediate access to burgeoning markets, a reduction in transportation costs, and the opportunity to offer quicker delivery times, which can be a significant competitive advantage.

Additionally, as urban sprawl continues and cities expand their boundaries, the value of well-located quarries will only appreciate. Future infrastructure projects, be it road expansions, housing projects, or commercial establishments, will require vast amounts of aggregates. Quarries in optimal locations will be best positioned to meet this demand, making them key targets when identifying M&A opportunities in aggregates.

Such geographically strategic acquisitions also offer an edge in negotiations with local authorities and in building relationships with construction companies. Being the closest and most accessible source of aggregates could result in preferred supplier status or long-term contracts, ensuring steady revenue streams and a robust market presence.

4. Technology Augmentation: The Digital Quarry

The digital transformation wave hasn’t left the aggregates industry untouched. Quarries with outdated technologies might struggle with operational inefficiencies. These same quarries can turn into lucrative acquisition targets if their only major drawback is technological backwardness.

5. Regulatory Green Lights: Compliance Ready Operations and M&A Opportunities in Aggregates

Navigating the labyrinth of permits, especially for mining operations, can be challenging. Acquiring a quarry or mine that already has its permits in place is akin to acquiring a golden ticket. For organizations looking to expand their operations swiftly, acquiring a pre-permitted site is an opportunity too lucrative to pass up.

In the multifaceted world of the aggregates industry, discerning the gold from the grit is both an art and a science. The real game-changers lie in the corners of the market that remain largely unexplored. For those serious about navigating this intricate landscape, seeking the right guidance and resources is essential.

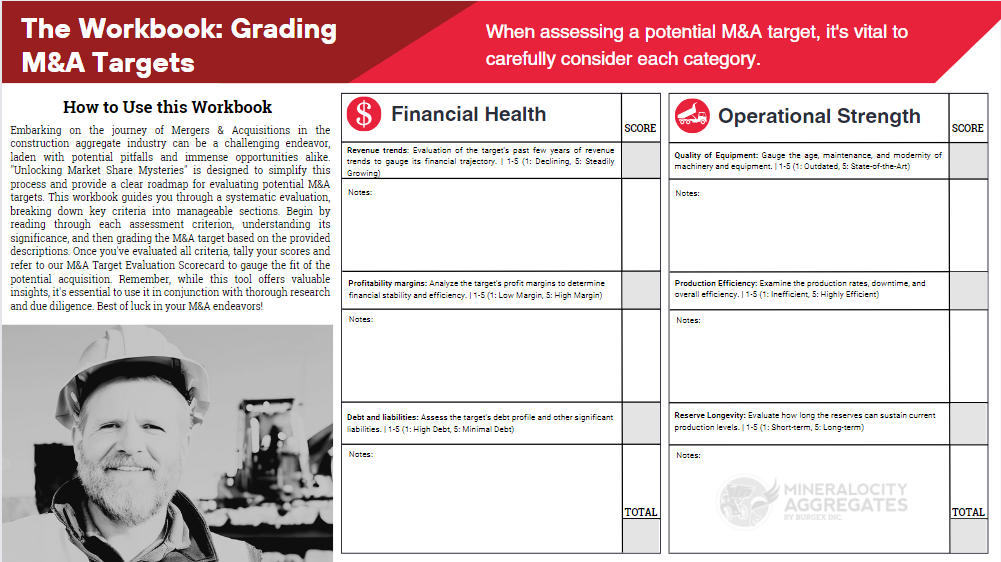

Enter Mineralocity Aggregates. With our unparalleled expertise and insight into identifying M&A opportunities in aggregates, we’ve crafted a comprehensive M&A workbook designed to be your north star. Dive into our M&A workbook and equip yourself with the knowledge, strategies, and confidence to unearth the best opportunities and drive unparalleled growth. Because in this industry, with the right tools at your disposal, the sky truly is the limit.

Are You Prepared to Master the Art of Aggregate M&A Target Evaluation?

Unlock the secrets of successful M&A in the aggregates industry with our comprehensive workbook. Packed with actionable insights, best practices, and strategic tools, this guide is your blueprint for making informed, profitable decisions.

Don’t miss your chance to elevate your M&A game—download now!