Mergers and acquisitions (M&A) in the construction aggregates sector offer the potential for growth, enhanced market presence, and strategic positioning. However, before diving headfirst into an acquisition, there’s the crucial step of due diligence. It’s where you identify potential risks, validate assumptions, and understand the true value of the target. Here, we lay out the basics of the due diligence process and highlight how tools like Mineralocity Aggregates can be invaluable in this endeavor.

1. Understanding the Market Landscape

The construction aggregates market isn’t static. It’s influenced by various macro and microeconomic factors that can shift demand, pricing, and competitive dynamics. Thoroughly understanding these elements can provide a clearer picture of the acquisition’s potential:

- Regional Demand & Consumption: Consider the current and anticipated demand within the operation’s region. Are there major infrastructure projects announced? What are the housing and construction trends? Using tools like Mineralocity Aggregates can provide insights into per-capita consumption trends, allowing for more accurate demand projections.

- Competitive Positioning: Identify the operation’s main competitors in its service region. How does the target operation’s product quality, price, and distribution capabilities compare? Is there a unique value proposition or a competitive edge?

- Supply Chain Dynamics: Evaluate the efficiency and resilience of the operation’s supply chain. Are there any vulnerabilities or over-reliances on particular suppliers or transportation routes? In the wake of disruptions like the global pandemic, a robust supply chain can be a competitive advantage.

- Pricing Trends: Delve into the historical and current pricing trends for aggregates in the region. Are prices stable, rising, or under pressure? Understanding the pricing power in the market can offer insights into future revenue potentials.

- Potential Market Saturation: Assess the possibility of market saturation. Are there many competitors in close proximity? Is there room for growth, or is the market nearing its peak?

- External Factors: Consider other external factors like economic growth rates, interest rates, and local government policies regarding construction and infrastructure development. These can have a direct impact on demand for construction aggregates.

By comprehensively evaluating the market landscape, you not only gauge the current position of the target operation but also its future potential. Partnering with platforms like Mineralocity Aggregates ensures that you’re equipped with the latest data and analytics to make informed decisions in this arena.

2. Financial Health and Valuation

The financial standing of a target operation is a primary consideration:

- Financial Statements: Thoroughly review balance sheets, profit & loss statements, and cash flow statements for at least the past five years. These documents will provide a clear picture of the company’s financial health and trends over time.

- Liabilities & Debt: Delve deep into any debts, pending litigations, or other potential liabilities. Understanding these commitments can influence the deal structure and price.

- Asset Valuation: In addition to the aggregates, consider the value of land, machinery, infrastructure, and any other tangible or intangible assets.

- Revenue Streams & Profitability: Identify the primary sources of revenue. Are they diversified, or is there a heavy reliance on a particular client or project? Assess profit margins to ensure they are in line with industry standards.

- Future Projections: Based on existing contracts, market trends, and other variables, what do the revenue projections look like? Are there expansion plans or new projects in the pipeline?

It’s prudent to have a thorough financial due diligence, possibly with the assistance of experts. Burgex Mining Consultants offer specialized financial assessment services tailored to the mining and aggregates sector, ensuring investors are well-informed and shielded from potential pitfalls.

3. Regulatory and Compliance Check

In the construction aggregates industry, regulatory compliance isn’t just a checkbox; it’s a cornerstone. Overlooking this area can result in fines, legal complications, or even cessation of operations. When evaluating a potential M&A opportunity:

- Permits & Licensing: Review all active permits and licenses. Ensure they are up to date and match the current operations. Look for any signs of past violations or challenges to permit renewals. Also, anticipate any upcoming renewals and assess the likelihood of approval.

- Environmental Assessments: Aggregates operations, especially mines and quarries, can have significant environmental footprints. Review previous environmental impact assessments, and note any conditions or mitigation measures. Check if the company has any unresolved environmental issues or pending actions.

- Health & Safety Records: In a sector where safety is paramount, it’s crucial to understand the operation’s health and safety history. Look for any recurrent issues or recent incidents that might indicate systemic problems.

- Land Reclamation & Closure Plans: For aggregate sites, the eventual closure and reclamation of the land is a significant responsibility. Examine the target’s plans for land rehabilitation. Is there a secured financial provision for this future obligation?

- Relationship with Local and Indigenous Communities: It’s becoming increasingly important to maintain good relationships with local communities. Investigate any ongoing disputes, agreements, or partnerships with local or Indigenous communities. These relationships can heavily influence permit renewals and public perception.

- Upcoming Regulatory Changes: Anticipate future regulatory shifts that might impact the operation. This requires a pulse on local, state, and federal policy directions, especially concerning environmental and land-use regulations.

4. Operational Assessment

To understand the true potential and existing issues of an aggregates operation, a comprehensive operational assessment is indispensable:

- Infrastructure & Equipment: Examine the condition and adequacy of the machinery, tools, and infrastructure. Are they up-to-date, or would significant investments be required for upgrades?

- Operational Efficiency: Scrutinize production rates, downtime instances, and maintenance schedules. High efficiency often correlates with a well-managed operation.

- Safety & Compliance: Ensuring the operation complies with local, state, and federal safety and environmental standards is paramount. Review any past incidents or violations and their subsequent resolutions.

- Reserve Assessment: How much aggregate remains, and how accessible is it? A professional geological survey can offer insights into the longevity and quality of reserves.

Tip: If unsure about how to comprehensively assess the operation’s specifics, consulting experts such as Burgex Mining Consultants can provide an in-depth analysis, ensuring no stone (or aggregate) is left unturned.

5. Team and Staff Evaluation

A critical yet often overlooked component of a successful merger or acquisition in the construction aggregates sector is the team behind the operation. It’s essential to understand the knowledge, experience, and expertise that the existing staff brings to the table:

- Leadership Quality: Assess the management team’s track record. Are they seasoned veterans with a history of successful operations? Do they command respect within their teams and the broader industry?

- Skill Set: Beyond the leadership, does the team possess the necessary skills to execute their roles efficiently? For positions crucial to the aggregates sector, such as site managers, engineers, and safety personnel, are there clear indications of their proficiencies?

- Organizational Culture: The culture of an organization can significantly impact its performance. Understand the existing company culture. Is it one of safety, efficiency, and continuous improvement, or are there signs of systemic issues?

- Retention Rates: High staff turnover can be a red flag. Look into the historical retention rates of the company. A stable workforce often indicates good management, job satisfaction, and a positive working environment, all of which can be crucial for seamless integration post-acquisition.

- Training and Development: Investigate the company’s approach to training and staff development. Continual learning and adaptation are crucial in the ever-evolving aggregates sector. A company that invests in its people is often better poised for long-term success.

The value of an experienced, cohesive team cannot be overstated. While assets, licenses, and market positioning are crucial, it’s the people that drive operations day-to-day. Ensure that the acquisition doesn’t just make sense on paper, but that there’s a team in place capable of executing the vision.

6. Strategic Fit

Assessing how the potential acquisition aligns with your existing business strategy and portfolio is critical:

- Alignment with Business Objectives: Consider if the acquisition complements your current operations or provides diversification. Is this acquisition a move to consolidate within a particular market or to venture into new geographies or product lines?

- Market Position & Brand Value: Analyze the target’s market reputation. Will it enhance your brand’s equity or require rebranding and reputation management?

- Synergy Potential: Look at potential operational synergies. Can facilities, equipment, or staff be consolidated? Are there opportunities for cross-selling or shared logistics that can reduce costs?

- Cultural Fit: Don’t underestimate the importance of organizational culture. Assess the target company’s values, work ethic, and employee morale. A cultural misfit can lead to post-acquisition challenges, including talent attrition and lowered productivity.

- Technological Integration: If the target company utilizes specific technologies or software, evaluate the ease of integration with your existing systems. Seamless technological integration can simplify the post-acquisition transition.

- Growth Potential: Assess the potential for expanding the acquired operation. Are there untapped markets, customer segments, or other opportunities that align with your growth strategy?

When examining strategic fit, it’s essential to have a long-term vision. An acquisition that fits seamlessly can lead to accelerated growth, while a misfit might result in unforeseen challenges. It’s always a good idea to consult with strategic experts, especially those familiar with the aggregates industry, to ensure that your acquisition will be a harmonious addition to your business portfolio.

The Mineralocity Aggregates Advantage

In the complex landscape of M&A due diligence for the aggregates industry, having a reliable tool can be a game-changer. Mineralocity Aggregates is such a tool. It offers a comprehensive platform to evaluate market conditions, providing data-driven insights that streamline the due diligence process. With over 800 labor hours invested in each update, Mineralocity Aggregates ensures you have the latest trends and data at your fingertips. It’s an indispensable tool for anyone serious about making informed, strategic decisions in the aggregates sector.

Conclusion

Navigating the complexities of M&A in the construction aggregates sector requires a well-structured approach. From understanding the basics of supply and demand to evaluating the operational team, there’s much to consider. And while these steps provide a foundation, having the right tools at your disposal can be a game-changer. Mineralocity Aggregates offers investors unparalleled insights, data, and analytics to ensure that every acquisition opportunity is assessed comprehensively. Dive deeper, understand better, and invest smarter with Mineralocity Aggregates.

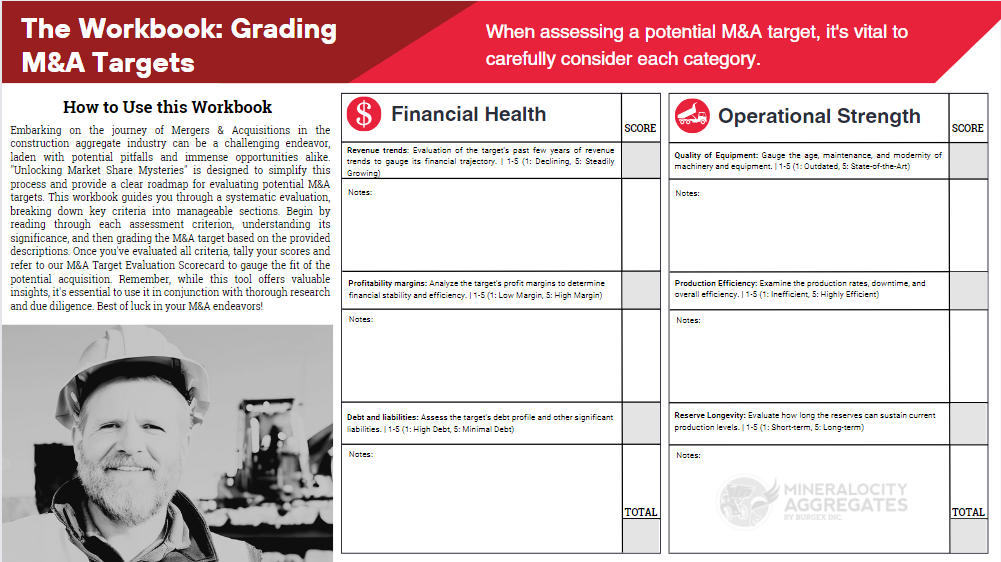

Are You Prepared to Master the Art of Aggregate M&A Target Evaluation?

Unlock the secrets of successful M&A in the aggregates industry with our comprehensive workbook. Packed with actionable insights, best practices, and strategic tools, this guide is your blueprint for making informed, profitable decisions.

Don’t miss your chance to elevate your M&A game—download now!