The aggregate industry is rapidly evolving, with mergers and acquisitions (M&As) at the forefront of its transformation. While the financial benefits of these moves are often spotlighted, the potential for creating operational efficiencies — or “Aggregate Merger Synergies” — is equally significant, especially when acquisitions occur within the same region.

Aggregate Merger Synergy #1: Enhanced Distribution Nodes

Harnessing Aggregate Merger Synergies, especially within the same region, offers a golden opportunity to capitalize on enhanced distribution nodes. This essentially means multiple distribution points, strategically located, that can serve a wider area efficiently. But what exactly does this entail?

Centralized Inventory Management: With multiple nodes, inventory can be managed centrally. This ensures that any supply shortages in one node can be quickly addressed by redistributing from another nearby node, guaranteeing consistent supply to all clients.

Reduced Delivery Times: Proximity to key markets means reduced transportation distances. The result is faster delivery times, which not only delights customers but also means lower transportation costs, translating to better margins.

Adaptive Distribution Strategies: With multiple nodes at their disposal, aggregate companies can swiftly adapt to changing market conditions. For instance, if there’s an unexpected construction boom in a particular area, nearby nodes can prioritize supplies to that region.

Economies of Scale: As the number of distribution nodes increases, aggregate companies can benefit from economies of scale in terms of procurement, storage, and distribution. Bulk purchases, for instance, become more feasible and cost-effective.

Increased Market Penetration: With more distribution nodes, companies can penetrate deeper into existing markets, reaching even the more remote clients. This enhanced reach can significantly boost sales and revenue.

By acquiring operations close to existing assets, companies can immediately leverage these benefits of enhanced distribution nodes. The proximity ensures materials can be transported to customers more efficiently, fostering increased loyalty and bolstering customer satisfaction.

Aggregate Merger Synergy #2: Shared Infrastructure and Maintenance Staff

“Aggregate Merger Synergies” not only speaks to the strategy of combining operations but also to the tangible benefits gained from sharing vital infrastructure and maintenance resources. When operations in the same region combine forces, they can leverage shared assets for maximum efficiency. Let’s explore how:

Unified Equipment Management: Instead of each site having separate equipment with potential downtimes, merging allows for the pooling of machinery. This leads to better equipment utilization rates and decreased periods where costly equipment is lying idle.

Centralized Repair Centers: Instead of scattered repair and maintenance facilities, a centralized hub can serve multiple operations. This allows for specialized technicians, bulk purchase of spare parts, and quicker response times, ensuring minimal disruption to operations.

Optimized Logistics: Shared transportation and storage facilities mean that logistics become a more streamlined affair. Trucks and conveyors can serve multiple sites, reducing the need for redundant assets.

Shared Expertise: Maintenance isn’t just about machinery. It’s about the people who operate and care for that machinery. By combining forces, teams can share expertise and best practices, leading to more consistent and efficient maintenance routines.

Bulk Purchasing Power: When multiple operations come together, their collective purchasing power increases. Whether it’s buying machinery, spare parts, or maintenance services, bulk purchases often translate to cost savings.

In essence, the synergy arising from shared infrastructure and maintenance can lead to significant cost reductions. Moreover, with streamlined processes and a collective approach, the operational efficiency of the merged entities can see a marked improvement, reinforcing the value proposition of the merger.

Aggregate Merger Synergy #3: Streamlined Management

Within the domain of “Aggregate Merger Synergies,” the consolidation of managerial roles and responsibilities can be a game-changer. As operations within the same region merge, there’s a golden opportunity to optimize and harmonize the managerial landscape. Here’s why shared management stands out:

Unified Vision and Strategy: With a shared management team, there’s a single vision guiding the merged entities. This unified direction ensures that all sites work cohesively towards a common goal, eliminating potential conflicts and disjointed strategies that can arise with separate management.

Reduced Overhead Costs: By eliminating redundant managerial positions, companies can realize significant cost savings. Instead of multiple managers overseeing similar roles across different sites, a streamlined managerial team can efficiently handle combined operations.

Faster Decision-Making: A consolidated management structure tends to result in quicker decisions. With fewer hierarchical layers and a centralized leadership, responses to market changes or operational challenges become more agile.

Knowledge Sharing and Best Practices: Shared management fosters an environment where knowledge transfer becomes the norm. Managers from different sites can share insights, experiences, and best practices, enhancing the operational efficiency of the entire merged entity.

Enhanced Stakeholder Communication: With a unified management team, communication to stakeholders—whether they’re investors, employees, or partners—becomes more consistent and transparent. This clarity can bolster stakeholder confidence and trust in the merged organization’s direction and decisions.

Incorporating shared management within the fabric of “Aggregate Merger Synergies” not only provides immediate cost and operational benefits but also sets the foundation for long-term growth and sustainability of the combined entities.

Aggregate Merger Synergy #4: Leveraging Local Market Knowledge

When considering “Aggregate Merger Synergies”, understanding and integrating local market intelligence becomes paramount. As operations within a specific region consolidate, companies gain the invaluable advantage of pooled local knowledge. Here’s why this collective wisdom stands out:

In-depth Customer Insights: By merging with an operation already embedded in the local market, companies can instantly access a treasure trove of customer preferences, habits, and feedback. This data enables tailored marketing strategies, product tweaks, and enhanced customer service approaches.

Navigating Regulatory Challenges: Local markets often come with unique regulatory landscapes. Acquiring a company with years of on-ground experience means benefiting from their established relationships with local authorities and their understanding of navigating local regulations efficiently.

Identifying New Opportunities: A combined local perspective provides a more holistic view of untapped market segments, emerging trends, or underserved customer needs. Leveraging this knowledge can lead to innovative products or services that address these gaps.

Risk Mitigation: Local knowledge often extends to understanding market risks, whether they’re geopolitical, economic, or environmental. By pooling insights from multiple local teams, companies can devise more robust risk assessment and mitigation strategies.

Cultural Synergies: Beyond just operational and market insights, understanding the local culture, values, and norms is essential. It aids in ensuring that branding, communication, and community engagement are resonant and authentic.

In the realm of “Aggregate Merger Synergies”, the blending of local market knowledge is akin to piecing together a puzzle. Each piece, representing insights from different operations, culminates in a comprehensive and actionable picture of the local market.

Aggregate Merger Synergy #5: Efficient Resource Allocation

The essence of “Aggregate Merger Synergies” isn’t just about combining forces, but about judiciously deploying resources to capitalize on those combined strengths. Efficiently allocating resources post-merger can be transformative, with several key benefits:

Optimized Equipment Utilization: Instead of each operation owning and maintaining separate sets of equipment, mergers can lead to a centralized pool. This allows for the flexible deployment of machinery based on demand peaks, thereby minimizing idle time and maximizing utilization rates.

Centralized Procurement: By consolidating procurement processes, companies can leverage their increased purchasing power to negotiate better terms with suppliers. This can lead to significant cost savings and improved supply chain reliability.

Redistribution of Workforce: With a broader operational landscape, employees can be strategically positioned where they are needed most. This can help in addressing workforce shortages in one location by reallocating personnel from another.

Streamlined Inventory Management: Holding inventory ties up capital and can be costly. By assessing the combined inventory needs and turnover rates, companies can reduce redundant stock, maintain optimal inventory levels, and decrease warehousing costs.

R&D Synergies: Research and development, especially in product innovation and process improvements, can be centralized. This prevents duplicate efforts, streamlines innovation pipelines, and allows for faster rollout of advancements across merged operations.

Through “Aggregate Merger Synergies”, the objective isn’t merely about adding resources but deploying them in a manner that extracts the maximum value for both operations and customers. This strategic distribution and management of resources can lead to significant operational efficiencies, cost savings, and competitive advantages.

Conclusion

Operational synergies provide the foundation for successful mergers and acquisitions in the aggregates industry. By fostering enhanced distribution, shared infrastructure, consolidated management, localized market intelligence, and efficient resource deployment, companies can propel their combined entities towards unparalleled success.

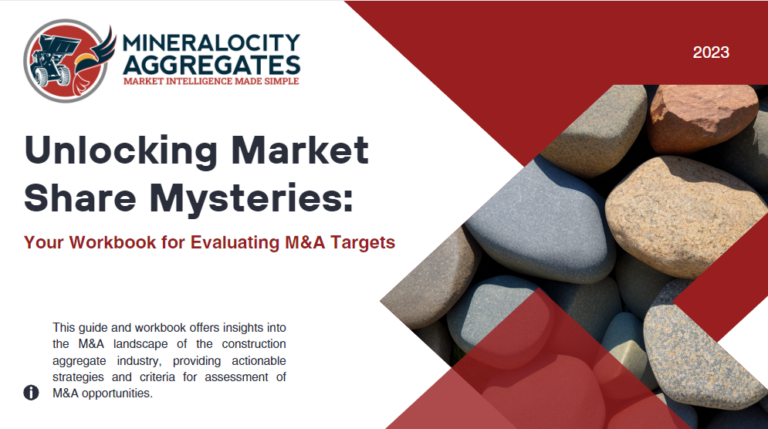

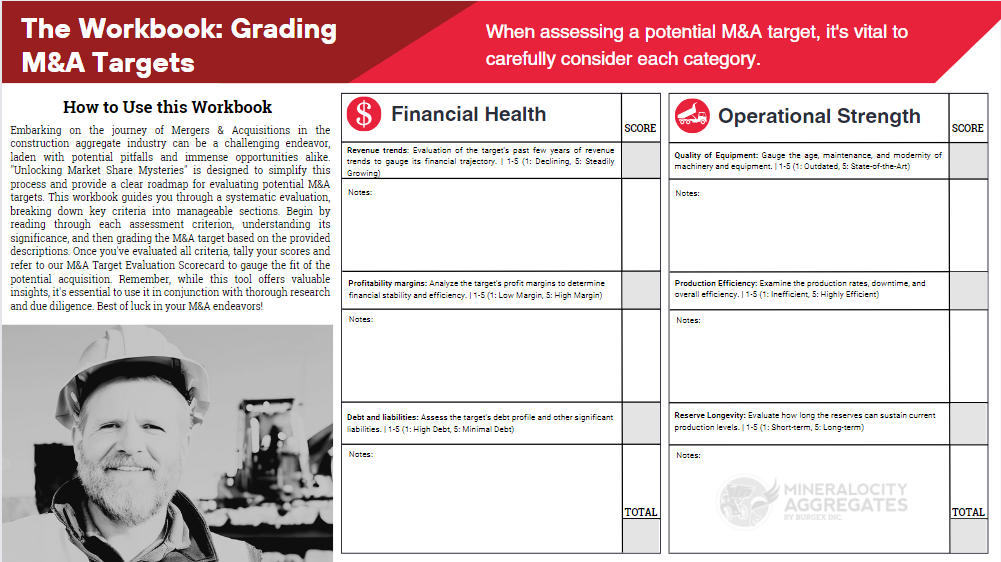

However, creating these synergies and maximizing their benefits requires a clear roadmap. That’s where our comprehensive M&A guide and workbook come into play. Designed to walk you through every facet of the M&A process, this resource is an invaluable tool for any company looking to explore the advantages of aggregate mergers.

Moreover, in an industry as dynamic as construction aggregates, you need a partner that understands the intricacies of the trade. Mineralocity Aggregates is not just a platform; it’s your trusted ally. From in-depth data insights to unparalleled market analysis capabilities, we ensure that you’re equipped with the best tools and knowledge as you embark on your M&A journey.

Unlock the full potential of aggregate merger synergies. Dive deep into our M&A guide, leverage the power of Mineralocity Aggregates, and pave the way for a brighter, more efficient future in the aggregates industry.

Are You Prepared to Master the Art of Aggregate M&A Target Evaluation?

Unlock the secrets of successful M&A in the aggregates industry with our comprehensive workbook. Packed with actionable insights, best practices, and strategic tools, this guide is your blueprint for making informed, profitable decisions.

Don’t miss your chance to elevate your M&A game—download now!